Study on ESG Reporting: Regulatory Requirements Pose Major Challenges for Companies

Würzburg, July 17, 2024 – BARC has published the study ‘The State of ESG and Sustainability Reporting’. It provides recommendations and valuable insights into the challenges currently facing companies that need to meet their ESG reporting obligations by 2025 and beyond.

Chris Neubauer, co-author of the study, commented “ESG reporting is evolving rapidly and companies need to adapt to meet increasing regulatory requirements. Our research shows that the need for resources and better software solutions is critical to meeting the challenges and ensuring sustainable success.”

Key findings and results

- ESG reporting standards: The European Sustainability Reporting Standards (ESRS) are used by 68% of companies, followed by GRI (28%) and IFRS SDS (23%). Europe favors ESRS (74%), while North America prefers GRI (50%) and SASB (38%).

- ESG reporting status: 42% of companies will have published their first ESG report by 2023, with a further 20% planning to do so by 2024. ESG reporting is most prevalent in the banking and finance sector (67%). Only 41% of DACH companies have published or plan to publish an ESG report, compared to 65% in the rest of Europe.

- Motivation: The main drivers of ESG reporting are customer reputation, regulatory requirements and internal process improvements. The focus on regulatory compliance increased from 38% in 2023 to 59% in 2024.

- Responsibility: Responsibility for ESG reporting increasingly lies with dedicated ESG/sustainability departments (33%), up 12 percentage points on the previous year. Finance (34%) and other departments (33%) are equally likely to be responsible.

- Challenges: 42% of companies struggle with a lack of resources and the same proportion face challenges dealing with multiple data sources. 38% have data quality issues.

- Software solutions: Integrating ESG software into existing IT infrastructures is problematic for 37% of companies, and 33% lack internal resources when it comes to selecting software solutions for ESG reporting.

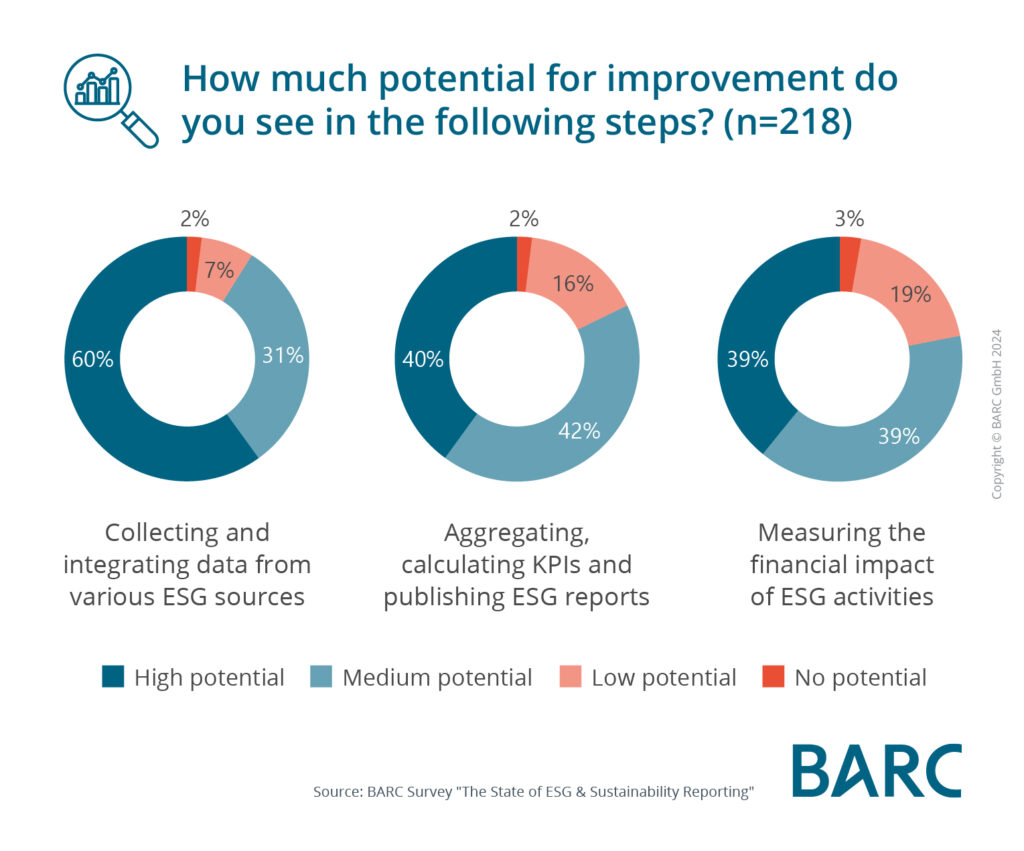

- Potential for improvement: 60% of respondents see significant potential in data integration and KPI management.

The study is available for free download here

Thanks to the sponsors Board, Jedox, LucaNet, Qlik and Wolters Kluwer that study is available free of charge.