Top Priorities for BI & Analytics Solutions Buyers Should Be Data-Driven

The BI & Analytics Survey 22 is published today.

The BI & Analytics Survey 22 is published today. The 20th edition of BARC’s flagship annual research study analyzes feedback from a survey of 2,478 users and consultants on their selection and use of business intelligence (BI) and analytics software. It uses empirical evidence and patterns in the survey data to update readers on today’s leading market trends and best practice in software selection.

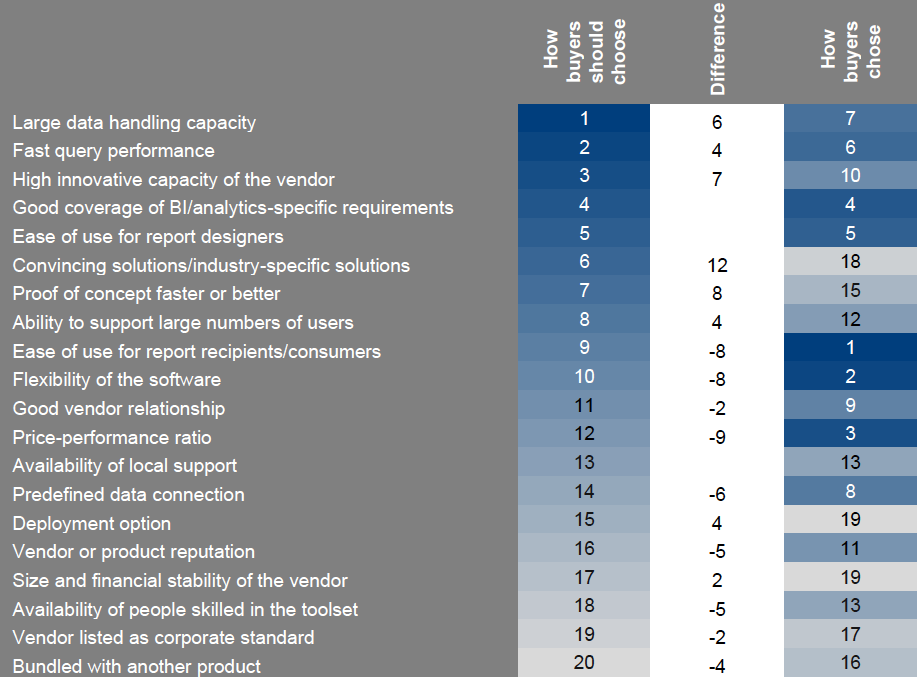

Not all reasons for purchase are created equal

When comparing the reasons why software was chosen with the level of benefits achieved, it is clear that buyers need to focus more on data-related considerations.

Those who prioritized ‘large data handling capacity’ when evaluating tools yielded the highest business benefits but this criterion was not among the top five buying priorities reported. The picture is similar with ‘query performance’. This is ranked second in terms of benefits delivered, demonstrating a strong correlation with project success, but is also outside the top five priorities of survey respondents. Slow query performance was also highlighted as a major problem by 15%, making it the most common cause for complaint by end users. Another area that deserves greater attention from buyers is the weight they give to proof of concept evaluations.

On the flipside, there are also criteria that have less influence on future success but are prioritized highly. The number one priority (‘ease of use for report recipients’) is more sought after than ‘ease of use for report designers’ but is less likely to generate concrete benefits. Another example is ‘price-performance ratio’, which was cited as the number three buying criterion by respondents.

“Buyers looking for software for smaller deployments are especially price-sensitive, but they would be well advised to focus on product-related criteria rather than on cost aspects to secure future benefits,” said Robert Tischler, Senior Analyst Data & Analytics at BARC and author of The BI & Analytics Survey 22. “ We have also noticed in the last two years that companies tend to take various technical aspects for granted such as large data handling capacity, fast query performance and the ability to support a substantial number of users. They reduce the focus on them, even if they should not do so. Furthermore, they increasingly rely on good vendor or product reputation, which is one of the least beneficial reasons to buy, instead of valuing a faster or better proof of concept.”

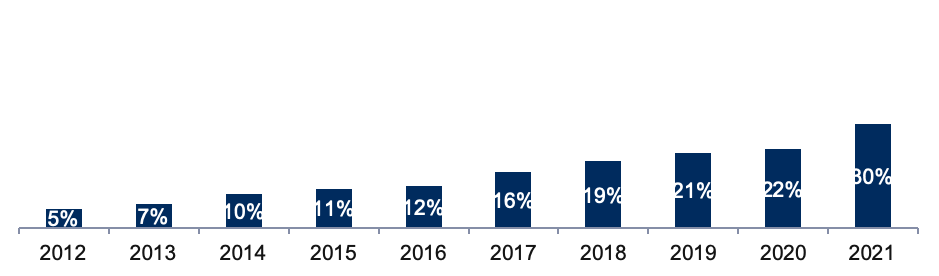

Surge in cloud analytics and BI over last 12 months

Many vendors claim that nearly all new buyers are opting for the cloud over on-premises but The BI & Analytics Survey data tells a slightly different story. Today, the share of new analytics and BI customers opting for the cloud (48%) is higher than for customers with implementations more than two years old (27%). This is leading to a steady increase in the overall use of cloud analytics and BI. In 2012, only 5% of customers were using it. Nine years later, that number has grown to 30%, with a huge increase coming in the last year.

“Most existing customers stick with their on-premises solutions unless serious problems begin to surface,” said Tischler. “However, vendors are continuing to become more cloud-centric and diversify their offerings. We expect many customers, even those who say they do not require the cloud today, to be drawn to cloud solutions.”

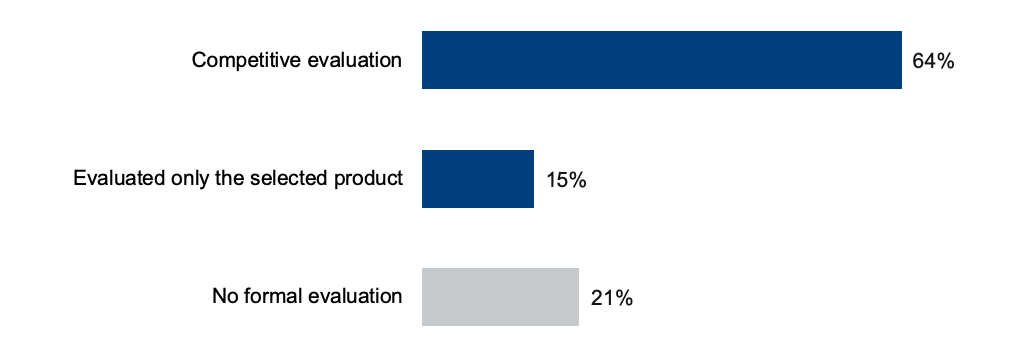

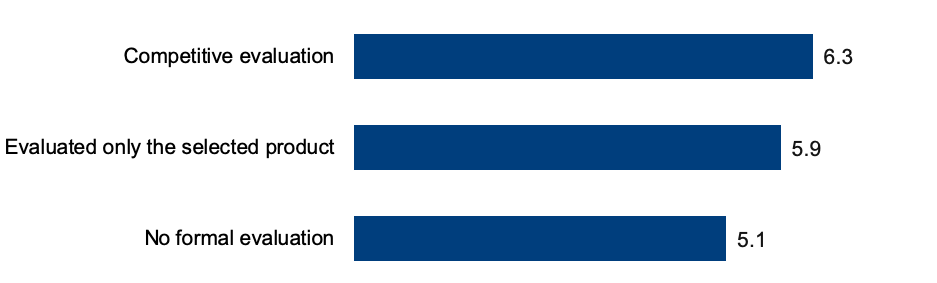

Finding the right evaluation method for sustainable success

The ratio of formal versus informal software evaluations conducted by analytics and business intelligence buyers has remained stable over time at around 4:1, indicating that while the technology changes, the fundamental approach to starting the analytics and BI endeavor has not altered to the same extent.

Competitive evaluations are clearly best practice (64%) at around three times the incidence of informal evaluations (21%) and four times that of single-product evaluations (15%).

“Finding the right software is arguably one of the most important steps a company must take to effectively use their data assets,” said Tischler. “However, many companies fail to vet and test multiple products thoroughly. Formally and competitively evaluated products deliver the best results for buyers. The difference in business benefits gained is obvious. A competitive evaluation is vital when selecting new software in a dynamic and competitive market.”

About The Survey

The BI & Analytics Survey 22 (formerly known as The BI Survey) is the 20th edition of BARC’s major annual study into the selection and use of analytics and business intelligence tools. Current data on market trends and issues ranging from the purchase cycle right through to deployment is supplemented by detailed analysis and comparison of customer feedback from users of 30 leading software products. The findings are based on a worldwide survey of 2,478 software users, consultants and vendors, which was conducted from late February to early June 2021.