Compare leading tools and software for group consolidation

Group consolidation is the process of combining the financial data of subsidiaries that meet the criteria of a related company into a single set of consolidated financial statements. The process involves a number of steps, from collecting and verifying data, to summarizing and eliminating intercompany transactions (consolidation), to preparing and analyzing reports.

- User rating

What is Board

Flexible, fully web-based platform with tightly integrated system architecture of proprietary multidimensional in-memory database and front ends. Graphical no-code development environment for business power users to create tailored planning and performance management applications.

- Functions (BARC classification)

Functions (BARC classification)

● = Function covered, ●● = Functional focus

● = Function covered

●● = Functional focus

- User rating

What is CCH Tagetik

Unified platform for financial corporate management (financial consolidation and close; budgeting, planning and forecasting; ESG and regulatory reporting; corporate tax). Supplementary solutions for financial and regulatory use cases (account reconciliation; financial reporting, disclosure management and iXBRL; transaction matching; IFRS 16, IFRS 17; and solvency II) as well as selected operational plans.

- Functions (BARC classification)

Functions (BARC classification)

● = Function covered, ●● = Functional focus

● = Function covered

●● = Functional focus

- User rating

What is CoPlanner

Integrated and feature-rich platform for building individual planning, budgeting and forecasting applications with supplementary functions for reporting, analysis and financial consolidation. Comprehensive planning functions for top-down and bottom-up planning including workflow support.

- Functions (BARC classification)

Functions (BARC classification)

● = Function covered, ●● = Functional focus

● = Function covered

●● = Functional focus

- User rating

What is Jedox

Flexible performance management platform for planning, budgeting and forecasting, reporting, dashboarding, analysis and financial consolidation, designed for business users. Supplementary marketplace for predefined but flexibly adaptable solutions and accelerators.

- Functions (BARC classification)

Functions (BARC classification)

● = Function covered, ●● = Functional focus

● = Function covered

●● = Functional focus

- User rating

What is Lucanet

Integrated software portfolio for financial performance management with solutions for financial consolidation and close, financial planning and budgeting, financial and legal reporting, ESG, tax and additional financial management topics.

- Functions (BARC classification)

Functions (BARC classification)

● = Function covered, ●● = Functional focus

● = Function covered

●● = Functional focus

- User rating

What is OneStream

Integrated performance management platform for financial consolidation and close, planning, budgeting and forecasting, reporting and analytics with built-in financial intelligence and financial data quality capabilities. Supplementary integrated marketplace with business and productivity solutions that allow customers to extend the platform with additional capabilities.

- Functions (BARC classification)

Functions (BARC classification)

● = Function covered, ●● = Functional focus

● = Function covered

●● = Functional focus

- User rating

What is Unit4 FP&A

Flexible, integrated performance management platform for planning, budgeting and forecasting, reporting, analysis, dashboarding and financial consolidation with complementary predefined business and industry solutions; focused on Unit4 ERP customers

- Functions (BARC classification)

Functions (BARC classification)

● = Function covered, ●● = Functional focus

● = Function covered

●● = Functional focus

- User rating

What is Corporate Planning Corporate Planner

Integrated platform for operational management, financial planning, sales management, financial consolidation, HR management and management reporting for business users. Comprehensive, predefined planning functions (with flexible capabilities for top-down and bottom-up planning) and business analyses.

- Functions (BARC classification)

Functions (BARC classification)

● = Function covered, ●● = Functional focus

● = Function covered

●● = Functional focus

- User rating

What is insightsoftware IDL

Integrated financial performance management platform for financial consolidation, financial planning, operational planning, management reporting, regulatory reporting and analysis.

- Functions (BARC classification)

Functions (BARC classification)

● = Function covered, ●● = Functional focus

● = Function covered

●● = Functional focus

- User rating

What is Prophix

Integrated, cloud-based performance management platform for mid-sized companies focused on planning, budgeting and forecasting, reporting and analysis. Comprehensive functionality for financial consolidation and close, management reporting, intercompany reconciliation as well as specialty solutions for IFRS 16 and iXBRL are available with the integration of Sigma Conso.

- Functions (BARC classification)

Functions (BARC classification)

● = Function covered, ●● = Functional focus

● = Function covered

●● = Functional focus

- User rating

What is SAP Business Planning and Consolidation (BPC)

Integrated solution for planning and financial consolidation based on SAP BW/4HANA as the technical basis with web and Excel front-ends

- Functions (BARC classification)

Functions (BARC classification)

● = Function covered, ●● = Functional focus

● = Function covered

●● = Functional focus

Are you a vendor and feel your solution is missing? Contact us to find out how to get your product listed.

Find out how we can help you.

Learn more about group consolidation software and comparing tools

Year after year, BARC market research studies and experience from consulting projects show that Microsoft Excel is still one of the most widely used tools in finance and controlling worldwide. This applies not only to the consolidation of group results and consolidated financial statements, but also to corporate planning, reporting and data analysis.

However, the widespread use of Excel solutions harbors a high potential for errors, causes process interruptions and leads to a lot of manual work. As a result, many users and companies are dissatisfied and invest in specialized software. Group consolidation and group accounting in general are currently priority investment areas for many organizations.

What is group consolidation and what do group consolidation tools do?

Group consolidation is the process of combining the financial data of the individual legal entities of an organization into consolidated financial statements (consolidated balance sheet, consolidated income statement, consolidated cash flow statement), eliminating intercompany transactions. The correct preparation of consolidated financial statements for all entities is essential for companies from a financial and legal perspective. It also serves as a guide for group-related decisions and for planning and controlling the entire organization.

Group consolidation can be divided into two main areas: legal consolidation and management consolidation.

- Legal consolidation: The aggregation and internal offsetting of the individual financial statements of group companies into consolidated financial statements in accordance with legal requirements (e.g., IFRS, HGB or local GAAP accounting standards).

- Management consolidation: Aggregation and reporting of management-relevant information for corporate management (e.g., summarized and consolidated presentation of subdivisions, business units and segments).

What are the typical features of group consolidation software?

Modern software solutions for group consolidation and the preparation of consolidated financial statements offer solid support and functionality for the following core tasks:

- Definition of all group companies to be included as well as the investment structures as the basis for consolidation (scope of consolidation).

- Integration of the data of all relevant group units (e.g. monitoring the timely delivery of data, transfer to the group standard (e.g. currencies), plausibility and consistency checks, etc.).

- Consolidation and standardization of the individual results of all affiliated organizations into a consolidated group result for expenses/income, liabilities and capital.

- Elimination of intercompany profits. Intra-group reconciliation of accounts, checking the consistency of accounting transactions between group companies and, if necessary, adjusting them (e.g. through postings).

- Reporting of group results (external and internal) to fulfill financial disclosure requirements (e.g. disclosure management) and analysis of financial data.

The group consolidation process and the preparation of consolidated financial statements involve many individual tasks and participants. Functions for controlling these processes (workflows) and all activities, including status monitoring, are therefore essential. In addition to defining who does what, when, and in what order, it is important to transparently monitor the progress of the process.

The diversity of tasks described above shows that group consolidation cannot be viewed in isolation, but is closely linked to other performance management disciplines. As a result, market-leading software platforms often provide functionality for:

- Financial planning: Planning financial results at group level, including consolidating the plans of group units (plan consolidation).

- Financial reporting: External reporting (disclosure management) and internal reporting of consolidated financial information.

- Financial analysis: Analysis of consolidated financial data (e.g., plan/actual deviations, trend analysis, error detection).

Increasing functional requirements such as faster consolidated financial statements (fast close), the inclusion of globally distributed subsidiaries, detailed management of the consolidation process, more extensive business requirements (e.g., accounting standards, compliance) and integrated and transparent financial management make the support of specialized software solutions indispensable for many companies today.

How group consolidation solutions add value

Market-leading software tools support the entire group consolidation process. This ranges from data integration from the source systems of individual group companies (e.g., ERP, financial accounting) through intercompany reconciliation and the actual consolidation of individual financial statements to the aggregated group result and its reporting.

Organizations most commonly achieve the following benefits and value with group consolidation tools:

- Faster group consolidation and preparation of consolidated financial statements

- Increased consolidation frequency

- Improved quality of consolidation results

- Increased transparency of group consolidation

- Reduced complexity of group consolidation

- Less resources required for group consolidation

- Better integration of group consolidation with financial planning, external reporting (disclosure management) and internal management reporting

- Better integration between group consolidation and other group accounting disciplines (governance/risk/compliance, tax, ESG, etc.)

Why you should compare group consolidation software and what to look for

Software solutions can only be of great value if they optimally meet a company’s consolidation needs. Therefore, a comparative evaluation of solutions is essential in the software selection process to find the right tool for your needs.

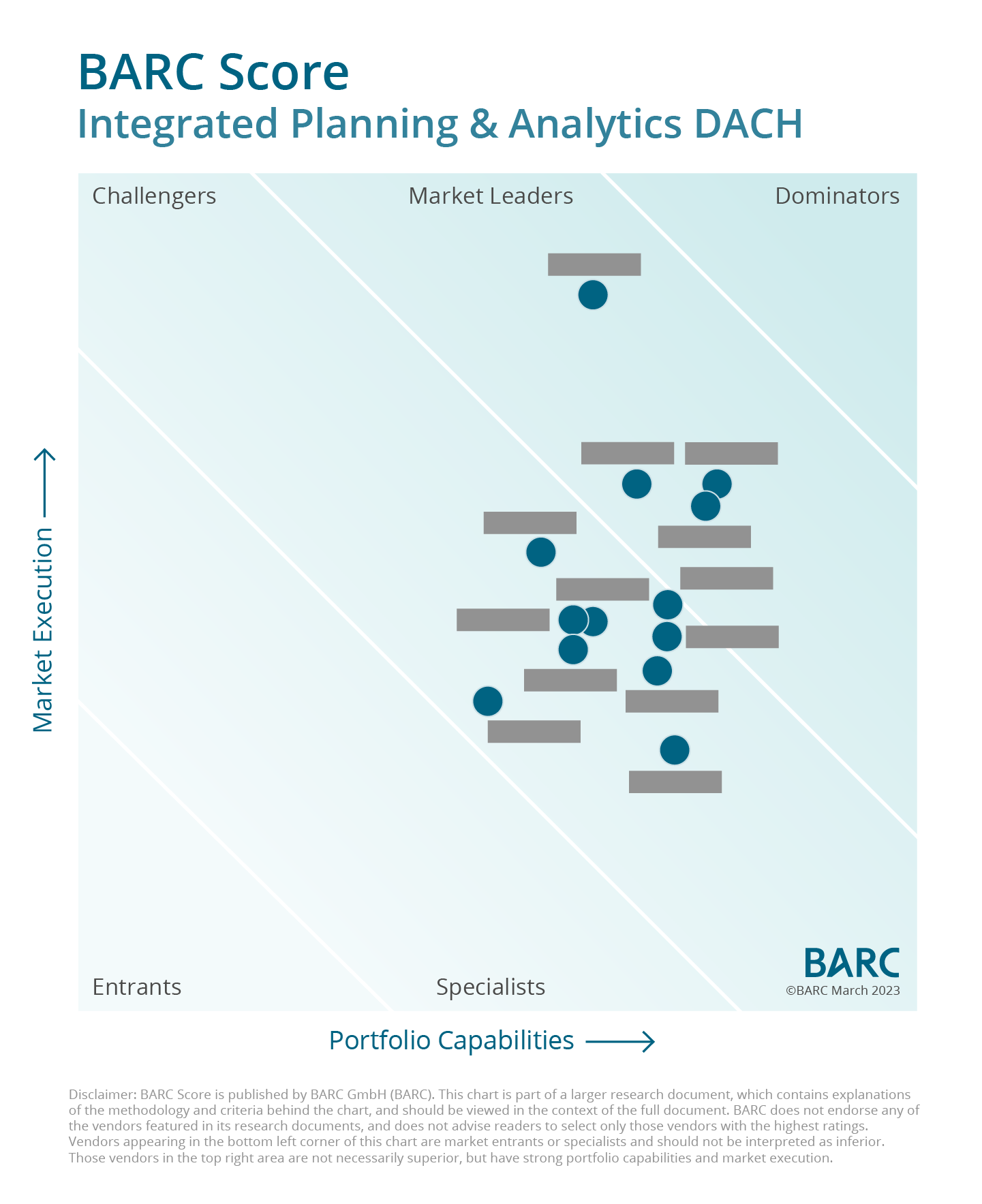

The software market for group consolidation and consolidated financial statements offers a wide range of tools. In addition to well-known, international vendors with strong sales and marketing strategies, there are often smaller, regional vendors in local markets that also offer sophisticated and comprehensive solutions. These vendors often have a very good understanding of local specialties in particular industries or company sizes.

The software selection process starts with a functional, technical and organizational requirements analysis for all parts of the company that will work with the tool. Further steps in the selection process are the creation of a long list, its reduction to a shortlist based on knock-out criteria from the requirements analysis, and the subsequent detailed evaluation of the solutions remaining on the shortlist.

As part of the detailed evaluation, the solutions under consideration should be scrutinized with regard to all relevant requirements and costs. The goal is to get as accurate a picture as possible of the software’s performance to provide investment protection. Failing to conduct a detailed evaluation of the shortlisted solutions – for reasons of time or cost, for example – is a common mistake in software selection processes.

In general, organizations should consider the following criteria when selecting a group consolidation solution:

- Coverage of all functional consolidation requirements (revenue/expense consolidation, debt consolidation, intercompany profit/loss elimination, capital consolidation)

- Support for multiple currencies and currency translation

- Mapping of group legal and management structures

- Control of the consolidation process and all parties involved (workflow including status monitoring)

- Predefined data integration functions and interfaces to source systems of all group units (e.g. ERP, financial accounting)

- High degree of user-friendliness

- Coverage of neighboring disciplines such as financial planning, financial reporting or financial analysis

- Embedding of the solution into the current and future system landscape/architecture

From group consolidation solutions to integrated group accounting suites

The increasing number of subsidiaries recognized in the consolidated financial statements of many companies and the more complex regulations for certain areas of the consolidated financial statements (e.g., income taxes, IFRS 16, IFRS 17) are increasing the demands on group accounting. Listed groups are also required to provide consolidated information in new areas such as risk management, sustainability and corporate governance at group level. As a result, companies need to disclose an increasing amount of information at group level and analyze it on a consolidated basis across multiple dimensions. This is one of the reasons why organizations need integrated and powerful software support for group accounting. In some cases, this goes far beyond traditional consolidation requirements to keep pace with increasing demands for efficiency, speed and automation.

As a result of the developments described above, new software offerings and comprehensive suites for group accounting are emerging in the market and are increasingly in demand. In addition to their core functions for group consolidation and consolidated financial statements, financial planning, financial reporting and financial analysis, they also offer integrated functions for governance/risk reporting/compliance, tax accounting/tax reporting/compliance and sustainability accounting/sustainability reporting (ESG).