Press Release: Consolidation Making Way for Integrated Group Accounting

- Laggards are still struggling with the core processes of planning and consolidation, while best-in-class companies are investing in new areas such as ESG (Environmental, Social, and Governance) and advanced analytics.

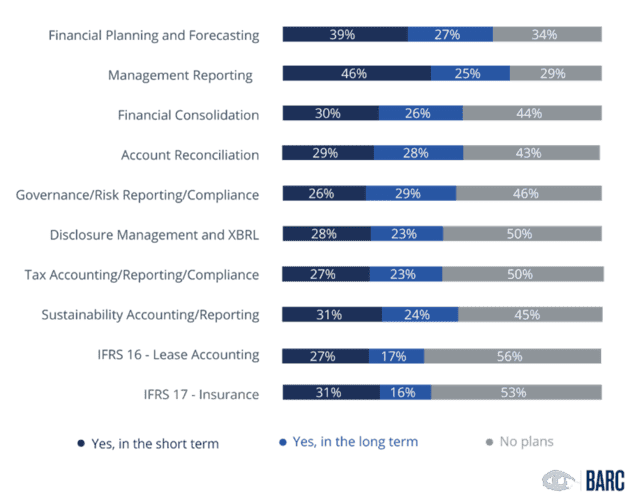

- High level of investment planned in 10 areas queried by BARC, with more than half of survey participants planning investments in eight of those 10 areas.

- Best-in-class companies now take a more holistic view of integrated group accounting.

BARC (Business Application Research Center) releases the results of its new topical survey “New Value for the CFO”. Based on a user survey of 235 decision-makers, the global survey offers insights into the current process of software support for the office of the CFO. The study is available for download free of charge thanks to sponsorship by Board International, Fluence Technologies, OneStream and Wolters Kluwer – CCH® Tagetik.

Transition from consolidation to integrated group accounting

“It is highly unusual for studies about investment priorities to reveal such a broad and evenly distributed picture of planned investment,” said Prof. Dr. Susanne Leitner-Hanetseder, Professor of Accounting and co-author of the study. “In our view this reflects the transition of user demand from a focus on consolidation to integrated or unified group accounting approaches. New areas such as sustainability reporting have accelerated this process recently.”

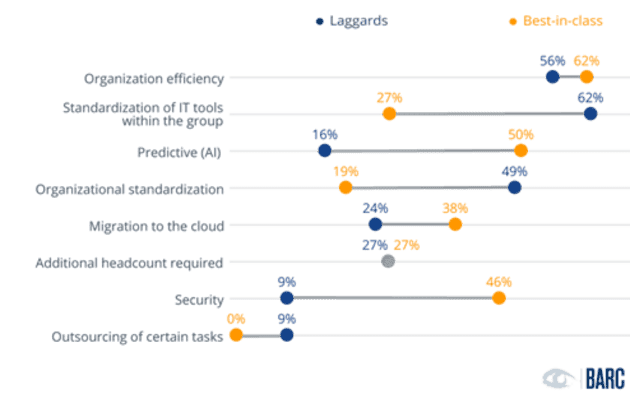

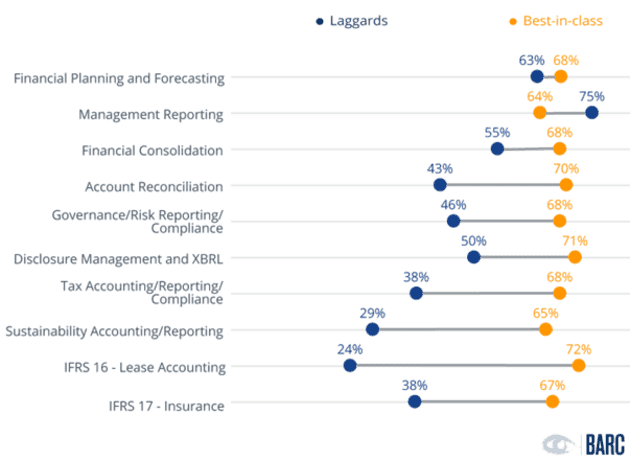

Best-in-class companies invest in new areas, while laggards struggle with core applications

BARC studies often analyze the differences between best-in-class companies and laggards based on self-assessment by survey respondents. The results show that laggards are struggling with the standardization of IT tools and organizational issues, leaving less time and capacity for innovation in areas such as predictive and AI.

What do you think are the most important factors that could improve your current group accounting solution? By best-in-class and laggards (n=71) © BARC

High level of investment

In terms of investment priorities, best-in-class companies have an extremely broad approach to the topic of group accounting. Meanwhile, laggards are still prioritizing the core topics of planning and consolidation in order to establish a sound basis for further group accounting automation.

The companies surveyed plan to invest heavily in ten areas queried by BARC, with more than half of the participants planning to invest in at least eight of these ten areas.

“Just as ERP systems were created many years ago by combining various standalone solutions, we now see integrated group accounting solutions emerging from consolidation systems,” said Stefan Sexl, BARC Fellow and co-author of the study. “This reflects the needs of users, as shown by our study. In particular, best-in-class companies are starting to look at group accounting software support more holistically nowadays.”

About The Survey

“New Value for the CFO” is a topical BARC survey assessing the challenges companies currently face in consolidation and group accounting. The study is based on a worldwide survey of 235 companies of various sizes and industry sectors. The focus of the survey was to assess current investment priorities, the challenges companies have faced in recent times and the priorities they have identified to overcome them. The authors of the study are Prof. Dr. Susanne Leitner-Hanetseder, Professor of Accounting at FH Steyr, and BARC Fellow Stefan Sexl.