Fast Results Are a Must for Corporate Management

BARC-Survey “Sound Decisions in Dynamic Times – Forecasts and Simulations Support Modern Corporate Management” published.

- Static methods and outdated tools fail in a dynamic environment

- Forecasts are replacing classical budgeting as the central instrument for corporate management

- Simulations are the basis for the sound analysis and evaluation of action alternatives, opportunities and risks

BARC (Business Application Research Center) today published the results of its topical survey “Sound Decisions in Dynamic Times – Forecasts and Simulations Support Modern Corporate Management”. The user survey of 275 companies examines how companies are adapting to an increasingly dynamic environment. The study is available for download thanks to sponsorship by Board, Corporate Planning, Cubeware, Jedox, OneStream and Unit4.

Constant change is the only constant in volatile times

The dynamics to which companies are exposed are being massively increased, not least by the global COVID-19 pandemic. The rapidity with which COVID-19 has overturned many things previously considered safe has brought the challenges of dynamics, volatility and complexity painfully back into focus.

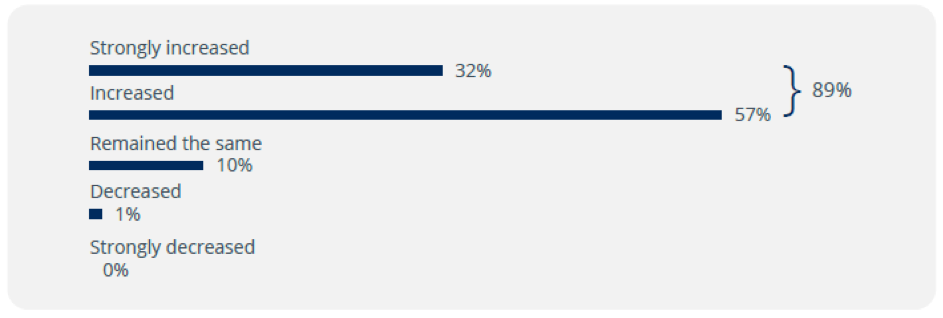

As expected, 89 percent of the survey participants confirmed that the dynamics in their field of business have increased in recent years. This applies generally to all company sizes and industries. Only a few organizations from the public sector reported a constant dynamic (23 percent). “Due to enormous upheavals in the markets, many established approaches to corporate management are coming under increasing pressure,” said Dr. Christian Fuchs, Senior Data & Analytics Analyst at BARC and co-author of the study.

Greater efficiency and effectiveness through acceleration, integration and automation

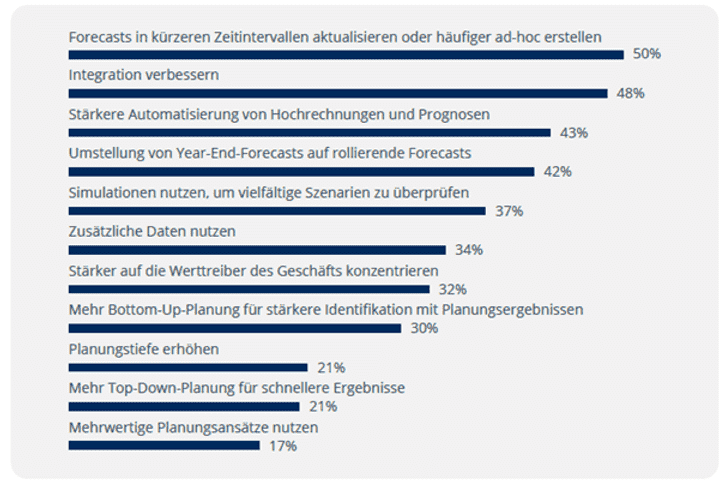

In order to withstand the increasing dynamics and pressure and remain capable of making decisions, half of the companies surveyed said they need to update their plans and forecasts more frequently. Many are therefore converting classic year-end forecasts to rolling forecasts (42 percent), which significantly improves their contribution to controlling.

The increased automation of forecasts is another means of enabling more meaningful simulations according to 43 percent. “Greater automation must always be critically examined, especially in the context of dynamics. While automation reduces reaction times and increases the transparency and consistency of results, it can also inhibit flexibility,” explained Robert Tischler, Senior Data & Analytics Analyst at BARC and co-author of the study. “Systems with sophisticated automation can therefore fail due to rapidly changing requirements. In practice, the solution for this is often found in Excel, which is not usually conducive to quality, efficiency and satisfaction.”

Dynamics describes the degree of change and increasing competitive pressure in markets. It is caused by innovation as well as changing social and political conditions. The development of highly dynamic markets is not fully predictable. Dynamics in markets have been rising for a long time and companies are feeling increasing pressure as a result.

About The Survey

“Sound Decisions in Dynamic Times – Forecasts and Simulations Support Modern Corporate Management” is a BARC market research study that addresses the current status of forecasts and simulations, and examines which measures need to be taken in order to use them effectively. It is based on a worldwide survey of 275 companies of varying sizes across all industry sectors. The authors of the study are Dr. Christian Fuchs and Robert Tischler, Senior Data & Analytics Analysts at BARC.