BARC-Survey: BARC Survey Suggests Interest in Predictive Planning May Have Peaked

The analyst firm BARC published the results of The Planning Survey 22 today. The eighth edition of BARC’s respected annual study collates feedback from 1,325 professionals on their selection and use of software for planning, budgeting and forecasting.

Year-on-year decline in predictive planning

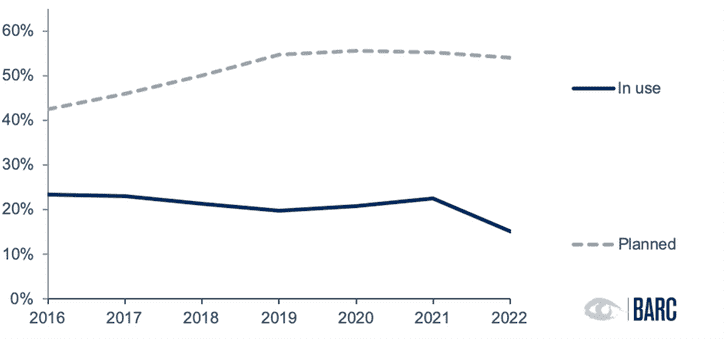

Until 2019, the proportion of companies with plans to make use of predictive planning and forecasting increased steadily each year. However, it has stagnated somewhat in recent years and this year it has decreased slightly for the first time. The rate of ‘planned’ use is at 54 percent in this year’s Planning Survey (see Figure 1). Also the proportion of companies that currently use predictive planning and forecasting has dropped significantly to just 15 percent (compared to 23 percent in 2021).

Figure 1: Use and planned use of predictive planning and forecasting, 2016-2022 (n=various) © BARC

“The big question is whether this development is a one-off or whether the hype around predictive planning and forecasting really is starting to cool,” said Dr. Christian Fuchs, senior analyst at BARC and author of The Planning Survey 22. “There are significant challenges to overcome in order to implement predictive planning and forecasting successfully.

Only valid use cases with the right data of the right quality with the necessary granularity and enough history allows solid predictions of probable future developments. Precise forecasts require a sufficiently large and well-maintained volume of data for training of algorithms as well as a deep understanding of cause-and-effect relationships and a high degree of integration between planning and analytics.

Furthermore, significant expertise, time and resources are needed to develop and continuously train algorithms, and decision-makers have to put their trust in the results. It would be understandable if some companies decided that they did not have all the right conditions or resources for success in such uncertain times.”

Integrating planning with reporting and analytics is key to success

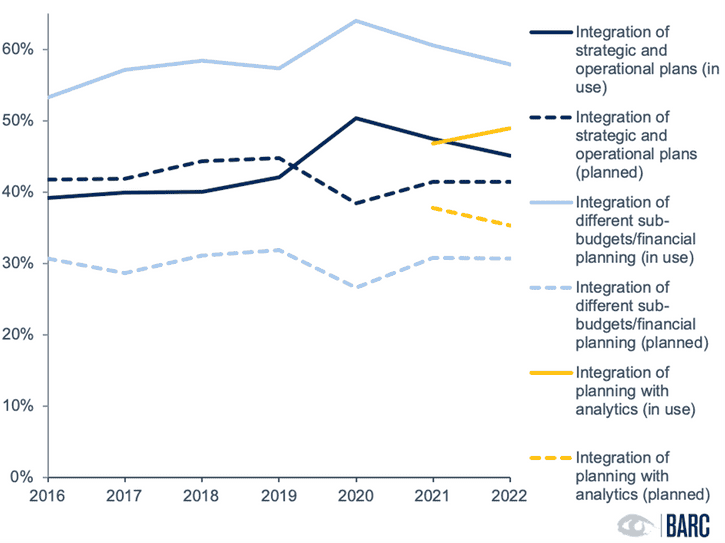

49 percent of the companies surveyed have integrated their planning and analytics, which is an increase of 2 percent compared to last year’s Planning Survey (see Figure 2). Meanwhile a further 35 percent plan to invest in an even tighter integration of planning with analytics and business intelligence in the future.

“Besides the comprehensive integration of planning, its integration with analytics as well as other performance management processes is essential for holistic corporate management and properly functioning performance management,” said Fuchs. “Not only do we see an increase in companies having already integrated their planning and analytics this year, but over a third of companies intend to invest in an even tighter integration of planning with analytics and business intelligence in the future. There is also a clear trend over the last five years of buyers paying more attention to reporting and analysis functionality when selecting their planning software.”

Figure 2: Time series for actual and planned integration of planning, 2016-2022 (n=various) © BARC

About The Survey

The Planning Survey 22 is the eighth edition of BARC’s major annual study into the selection and use of planning, budgeting and forecasting tools. The findings are based on a worldwide survey of 1,325 planning users, consultants and vendors, which was conducted from November 2021 to February 2022. It features current data on market trends and the selection and use of software, as well as a detailed comparative study of 19 leading planning products. Once again, BARC pledged to give €1 to charity for every survey completion. This year, a donation of €1,325 was made to UNICEF.

For more information, visit barc.com/de/en/research/the-planning-survey/