Investments in Big Data

Big Data Is A Job Engine

Since big data is just becoming established in enterprises, questions regarding its financing are of particular interest. How are companies financing their big data initiatives? Where are these investments being directed? Are budgets increasing, getting smaller, or remaining constant?

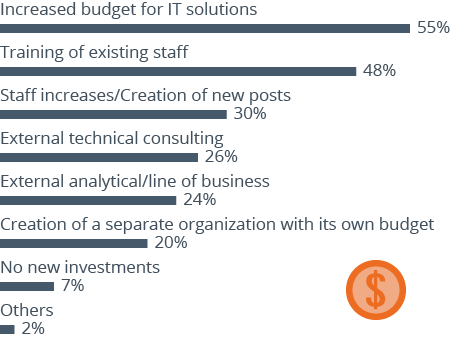

In companies that already use big data, most investments flow into a higher budget for IT solutions. Creating the technological requirements is apparently the first priority.

But since even the best technology cannot deliver benefits without the knowledge to use it properly, companies are also investing in training existing staff (48 percent) as well as hiring new employees. 30 percent of companies that already use big data want to create new jobs in this area. Big data, in other words, is a job engine.

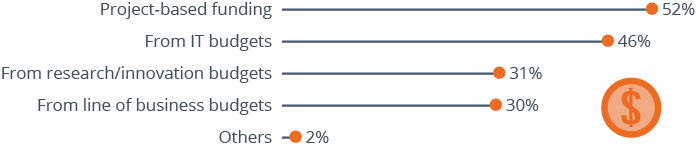

So where do the budgets for these investments originate? 52 percent of companies that already use big data fund their initiatives on a project-by-project basis. The topic is apparently not so tightly integrated in business processes that it flows into a fixed budget.

If it is part of the process, the funding primarily comes from the IT budget (46 percent). This is a further indication that big data is still usually driven as a technical topic.

A deeper look also reveals differences by region. While funding in North America frequently stems from IT (54 percent vs. 43 percent in Europe) and line of business budgets (39 percent vs. 24 percent), European companies are more likely to tap research budgets (20 percent in North America vs. 37 percent in Europe).

In North America, big data expenses are more likely to come from a fixed budget than in Europe. This, too, shows that North American companies are further along the road than their European counterparts when it comes to big data.

Changes in big data budgets are a clear sign that big data has established itself in companies.

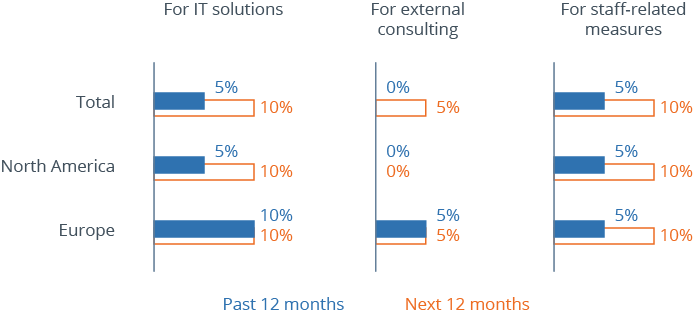

Expenditure on IT solutions and staff-related measures have both increased in the past twelve months. In companies that at least could conceive of big data initiatives, expenditure has gone up by five percent (median value). These companies, on average, are even planning a further five percent increase across the board for the coming twelve months.

The results across different regions are somewhat surprising. European companies invested five percent more on average in IT solutions and external consulting than North American ones. Since the absolute values behind these increases are unknown, we can assume that the lower investment in North America can be attributed to budget increases already made in the past.

European companies have apparently recognized the need to increase their investments if they want to keep up with the competition in North America.