The Most Common Business Intelligence Problems – 2,500 User Responses Analyzed

Are you looking for further assistance on this topic? You will find it here.

Planning and Anticipating Problems in Business Intelligence Projects

From technology issues to user requirements to company politics, it is rare to roll out a BI implementation on time without changes in scope. The unique combination of BI software, target users, technology environment and business requirements found in every project makes planning and anticipating problems in business intelligence projects tough even for seasoned BI professionals.

As such, we have witnessed agile approaches with continuous user engagement and incremental milestones gaining favor over traditional SDLC and project management approaches.

The BI Survey provides deeper insight into the implementation and post-implementation usage challenges in business intelligence projects facing organizations across different sizes and geographic regions.

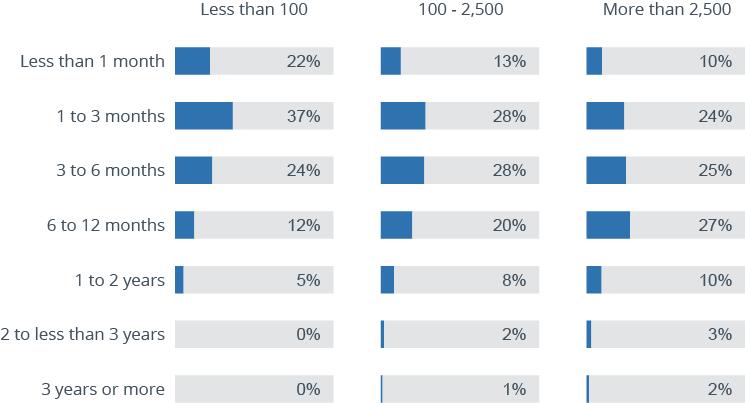

BI Application Rollout Times by Company Size

Approximately one in ten Bl projects can still take a year or more to complete.

Companies should strive to plan incremental rollouts with business benefits along the way even if completion is a year or more down the road. There is a clear trend demonstrating that implementation times extend as company size increases.

The opposite goes for the smallest companies. In this category, only 5 percent of the responses indicated project rollouts in 1 to 2 years with most (37 percent) happening in 1 to 3 months. While smaller companies usually have fewer application integration points and less data complexity, their smaller, empowered teams likely play a vital role in helping them move swiftly.

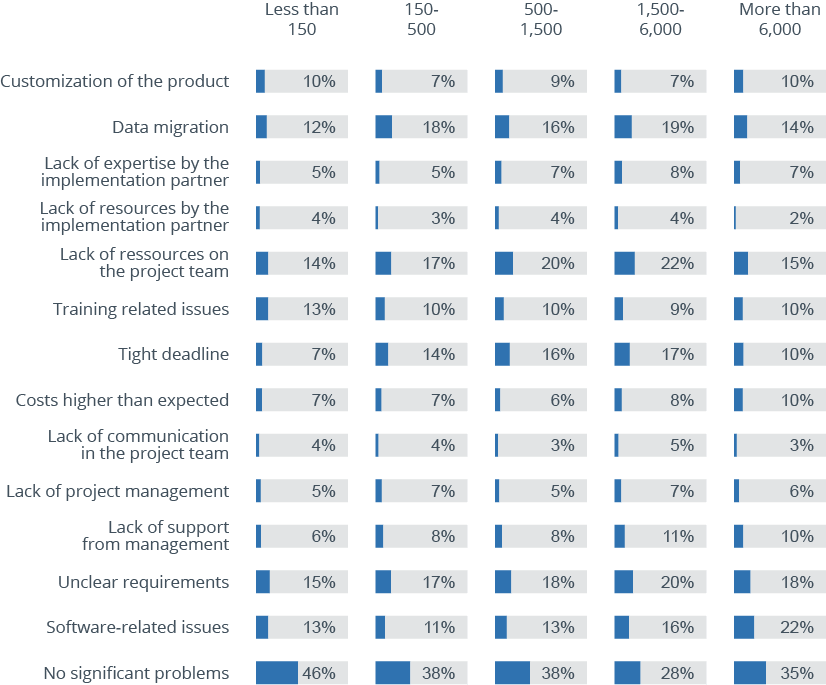

Business Intelligence Implementation Problems by Company Size

In the heat of implementation, many different issues can arise causing schedule delays and frustration for the project team. Across the largest organizations surveyed in 2016, the top three problems experienced during implementation are software-related issues (22 percent), unclear requirements (18 percent), and lack of resources (15 percent).

When looking at the smallest companies with less than 150 employees, we see that they also suffer from unclear requirements and resources as their top two problems but training issues is their third biggest implementation problem.

Other notable implementation issues include tight deadlines, experienced most frequently at mid-size companies, and data migration issues most regularly faced by companies with 150 to 6000 employees.

On the bright side, companies in the three smallest employee tiers reported the highest rate of “no significant problems”: 46 percent, 38 percent and 38 percent respectively.

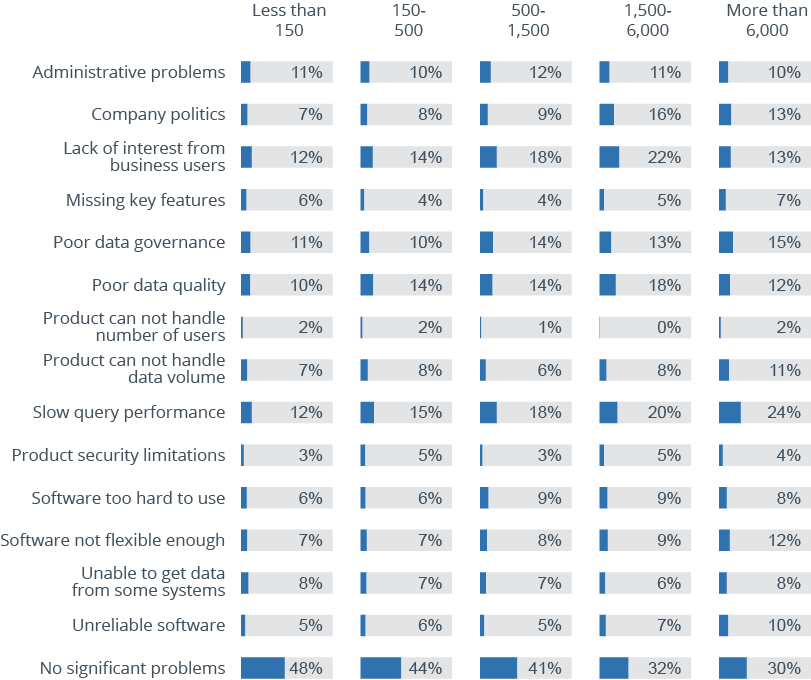

BI Usage Problems by Company Size

BI products such as TARGIT and Dimensional Insight achieve the vast majority of their growth by focusing on challenges in mid-market companies.

Even a general use case like self-service has different implications depending on organization size.

The chart below provides insights that can help guide product decisions based on unique BI challenges as company size changes. Key insights and takeaways include:

- Companies with 500 to 6000 employees should beware of lack of interest and engagement from business users

- Companies with over 500 employees should beware of data governance issues

- Except in the smallest companies, all BI leaders need to mitigate issues stemming from data quality

- Companies of all sizes have approximately equal chances of running into query performance issues

- Companies of all sizes have roughly equal chances of running into administrative problems

Vendors such as Cyberscience, who only assign very experienced internal staff for implementation services, can help companies navigate or outright avoid most of these issues.

Many of these challenges can be avoided through a sound development and rollout processes that engage business stakeholders early and often. For example, slow query performance can be detected through pre-production load testing if not during brief user acceptance tests against snapshots of production data.

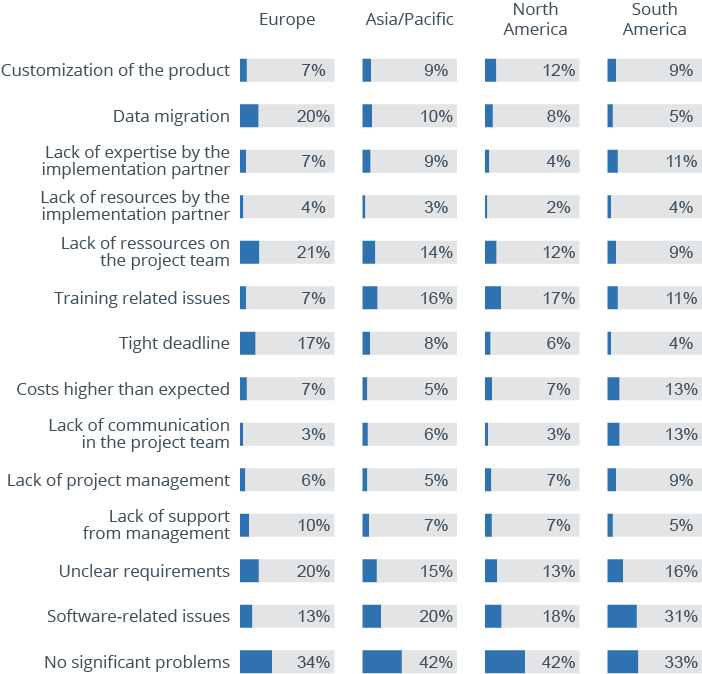

Business Intelligence Implementation Problems by Region

The most serious problems encountered during BI implementations often stem from training, requirements and software issues.

At least 20 percent of survey respondents from Europe also reported a lack of resources and data migration as causes for serious implementation issues.

Reviewing the top problems, one can see where BI project managers and vendors can make a big difference in project success or failure.

For example, implementation expertise is a factor that the vendor controls, but it’s up to the buyer to assess the qualifications of the actual resources assigned to their project.

Below are methods to mitigate the risk of facing this year’s top implementation issues in Europe, North America and Asia Pacific.

- Lack of Resources (Europe): scope out resource requirements as part of the software evaluation and purchase process. Ensure that resources, whether in-house or outsourced, come with the purchase of the software. Be conservative regarding what constitutes a part-time vs. full-time responsibility and the skills required for success.

- Software-Related Issues (Asia/Pacific, North America) once a shortlist of the top two or three products is defined, ask the vendor to assist in a proof-of-concept solution that includes actual integration (data, platform, devices) and development (visualizations, processes, styling) of the highest risk or highest value requirements. Clearly, identify must-haves vs. nice-to-haves with stakeholders at the outset of the project and establish consensus for key changes in prioritization.

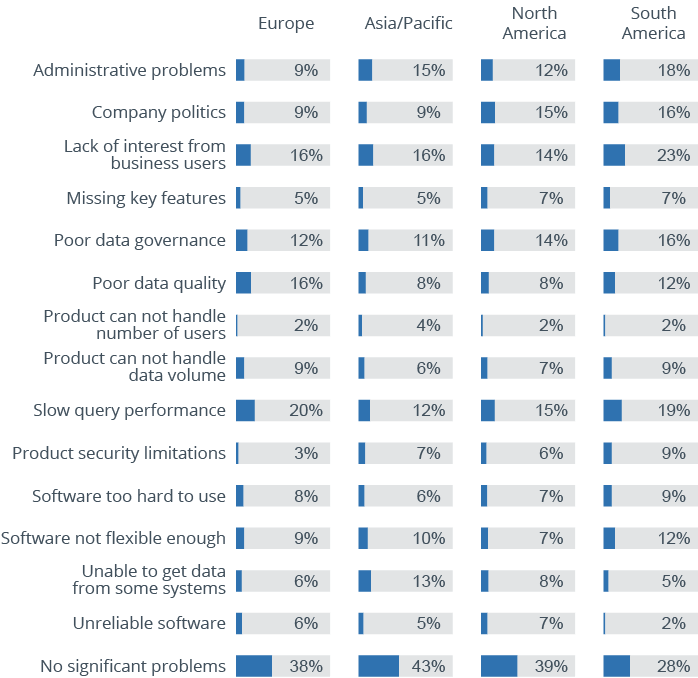

Most Serious Business Intelligence Challenges Encountered in the Use of BI Products by Region

Taken as a whole, the most serious issue arising from the use of BI is a lack of interest from business users.

Query performance, administrative problems, poor data governance and company politics rank close behind. Lack of user interest can stem from a range of issues including culture shock to measurement or inability of the information to impact success and performance.

Peaking at 20 percent for Europe, query performance remains four points higher than the next two problems: lack of interest from business users and poor data quality, both at 16 percent. In North America, query performance is tied with “company politics” (15 percent) as the top problem encountered during business usage of BI.

Although increased rigor during product selection may help in some cases, BI deployments grow much faster than most managers envision when they make the initial purchase.

Data sizes are almost always larger in production, and many other simultaneous processes compete for CPU time. Inadequate sizing of production resources may also cause BI environments to degrade when user and data loads increase quickly.

Reviewing the other key issues here (data governance, politics, user interest) and structuring projects to account for the ones that apply to your company can help your project avoid these roadblocks to success. On average across all regions, approximately one third (34 percent) of all BI projects experience smooth sailing with no significant problems, based on 2,586 survey respondents.

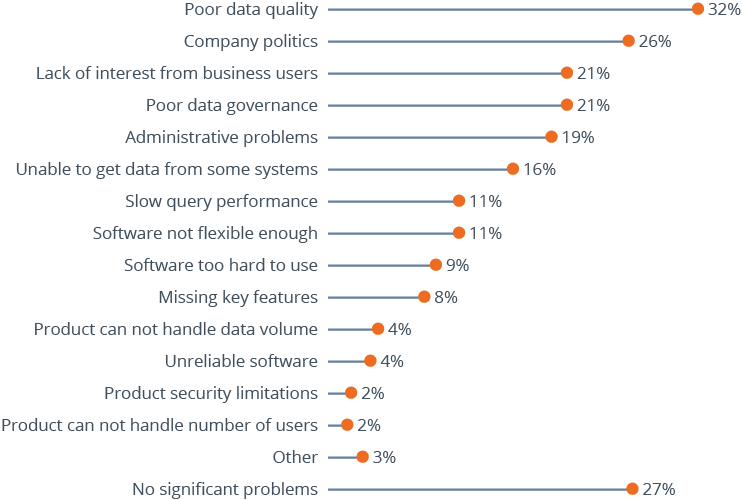

Problems Customers Typically Encounter with their BI Tool – Vendor Perspective

Based on 298 responses from the vendor community, the top two most serious problems that vendors say their customer’s report are poor data quality (32 percent) and company politics (26 percent).

While these two occupied the same position in last year’s survey, the third place response this year is “Lack of interest from business users” (21 percent). This result is somewhat interesting given that “lack of interest” held the number five position last year and the self-service trend remains on the rise. Perhaps these were first-time users who have never been exposed to metrics but now need to interact with them on a continuous basis.

BI vendors will seldom tackle or even identify these thorny issues during the sales process, but it’s crucial for buyers to spot these challenges early and allocate appropriate resources to drive the change necessary for success.

Solving most BI implementation problems involves constant collaboration, stakeholder engagement, and product expertise.

For example, addressing data quality issues typically requires a combination of business process and upstream systems changes – both complex situations requiring scope increases and only possible when there is a shared sense of ownership amongst functional owners.

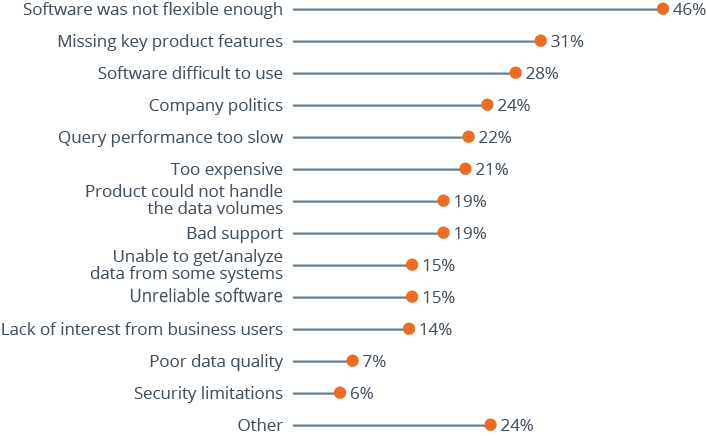

Reasons for Replacing Business Intelligence Software

Abandoning a BI software investment happens for a variety of reasons and is often painful, especially on high visibility projects.

The BI Survey 16 results indicate that BI software replacements are most often due to missing key features, difficulty in use, or a lack of flexibility. The same three factors also saw the largest year-on-year increases amongst all the reasons why companies abandon their BI software.

Luckily, buyers have good options for reducing the chance that one of these issues wreaks havoc at their company.

Replacement risk mitigation methods include increasing rigor during product evaluation, establishing a supportive political environment, and properly scoping dependencies on performance, security and user support capabilities.

With the growing availability of new and established products on public clouds, buyers can more quickly perform comprehensive product evaluations or even purchase the product for a limited period before committing to a long-term investment.

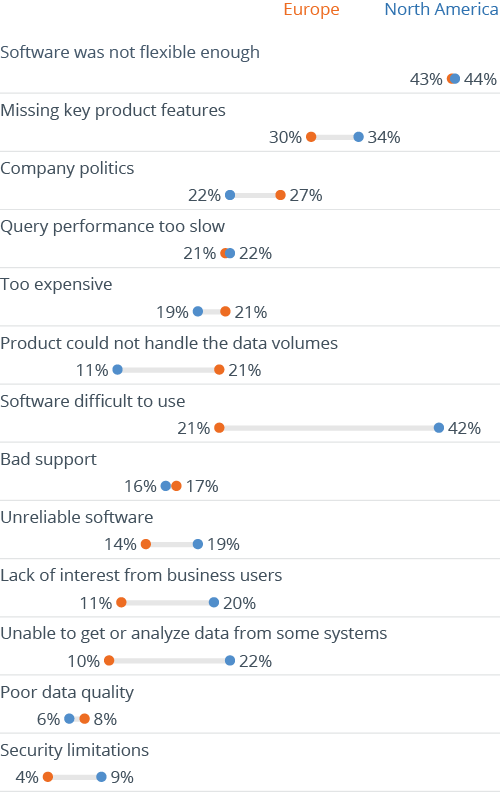

Reasons for BI Product Replacement by Region

In North America, 44 percent of replacements were due to “lack of flexibility” followed by “difficult to use” (42 percent) and “missing key features” (34 percent).

In Europe, “lack of software flexibility” also took the top spot (43 percent) followed by “missing key features” (30 percent) and “company politics” (27 percent).

When evaluating products, take time to understand the vendor’s track record around major product re-writes or changes. Know the product’s roadmap but don’t assume 100 percent of it will come to fruition on time. Instead, work with the vendor to determine how product gaps will be addressed now and longer term in the event that the roadmap changes.

Note that The BI Survey 16 Vendor Performance Summaries indicate whether a product is “in strategic development”, providing a helpful data point for gauging investment into the surveyed products.