BARC Survey Finds Business User Enablement Is Driving Investment in Data Management

The analyst firm BARC published The Data Management Survey 22 today. The third edition of this annual study analyzes feedback from a survey of 1,101 professionals on the selection and use of data management software. BARC publishes excerpts of the study here.

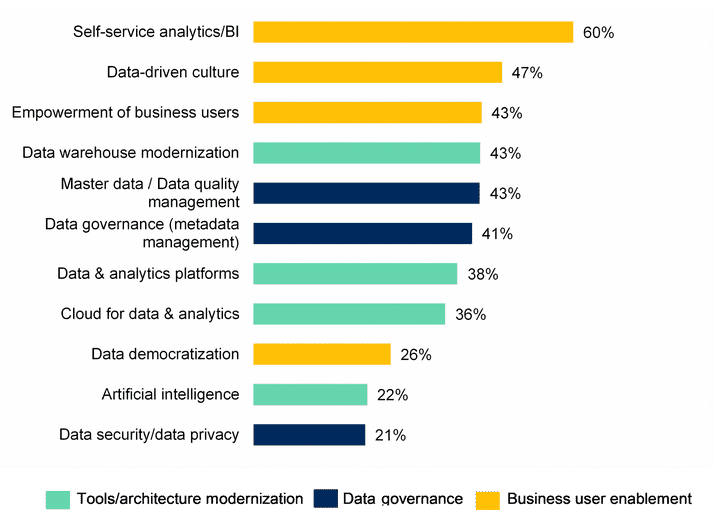

Key trends driving investment

The trends currently driving the most investment in data management initiatives relate to the enablement of business users. These include self-service, the fostering of a data-driven culture, empowerment of business users and data democratization.

Self-service in particular was highlighted by 60% of respondents and has also been among the top trends over the years in many BARC surveys, such as the Data, BI & Analytics Trend Monitor.

47% of respondents confirmed that the establishment of a data-driven culture is having a significant impact on their investments.

The concept of data democratization – in other words, allowing data access to as many employees as possible – has also been an important factor behind investments in data management for around one in four companies.

“The transformation of data management from pure IT discipline to a collaboration between business and IT is in full swing,” said Timm Grosser, Senior Analyst Data & Analytics at BARC and author of The Data Management Survey 22.

“Our survey clearly shows the relevance of business user enablement on investments in data management. In our opinion, this influence will continue to grow in the future as companies increasingly democratize their data and adopt new technological solutions. For this to happen, there has to be a common ground and understanding of data. Closely linked to business user enablement, data governance will therefore also play an essential role, as the survey also indicates.”

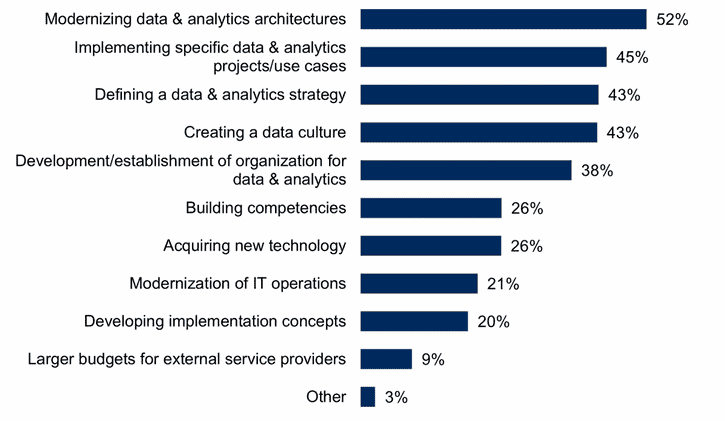

Top investment measure is to modernize data and analytics architecture

52% of companies are investing in modernizing their data and analytics architecture.

“The drivers for this are complex,” said Grosser. “Examples include the operationalization of advanced analytics models that require the integration of different systems and processes for optimal operation, or new use cases that require uniform data access to the distributed system landscape.

This leads to concepts such as data lakes, data lakehouses and data fabrics that help to provide data from different systems as efficiently as possible. The fact that so many companies are making such investments could be an indication that their historically grown systems no longer meet current needs for flexibility and agility as well as speed.”

Extended scope of The Data Management Survey 22

The Data Management Survey 22 has significantly expanded in scope this year. From analyzing user feedback about 12 data management tools last year, the new edition covers 20 software products from a diverse range of vendors. These include industry giants AWS (NASDAQ: AMZN) and Google (NASDAQ: GOOGL); global business software generalists Microsoft (NASDAQ: MSFT), Oracle (NYSE: ORCL) and SAP (NYSE: SAP); specialists such as Alation, Snowflake (NYSE: SNOW) and TimeXtender; and regional European players including 2150, Dataspot and Synabi.

About The Survey

The Data Management Survey 22 is the third edition of BARC’s annual study of the data management software market. The study is based on a worldwide survey of 1,101 data management professionals, which addressed questions about their software selection, implementation and usage. Detailed feedback on 20 established data management products is analyzed and compared. For more information, visit barc.com/research/the-data-management-survey/