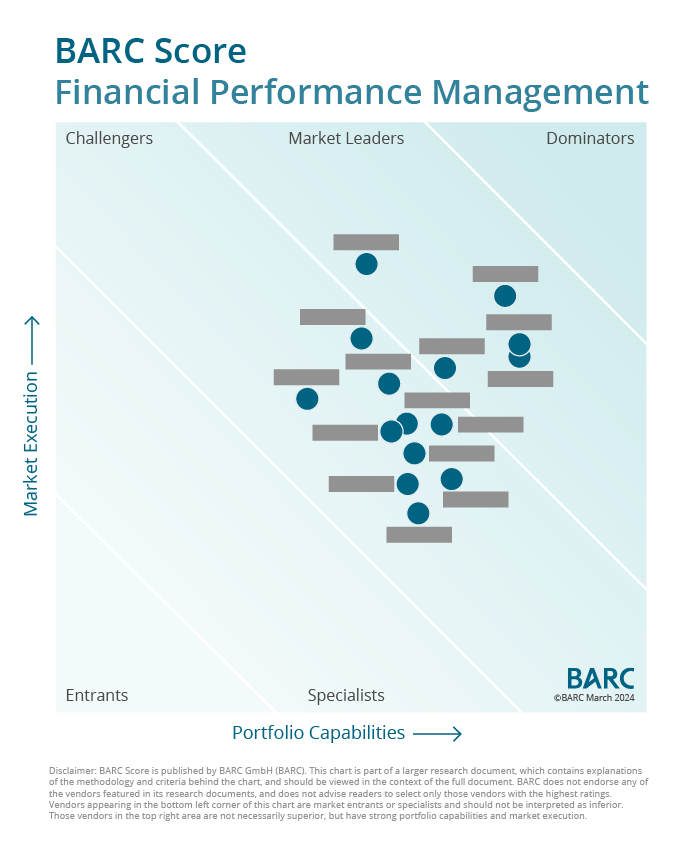

Leading Providers for Financial Performance Management – BARC Score

Würzburg, March 28, 2024 – The analyst firm BARC has published “BARC Score Financial Performance Management 2024“. This BARC Score provides an in-depth analysis of the software market for core financial processes such as financial planning and forecasting, financial consolidation and closing, financial reporting, and analysis of financial data.

Based on numerous data points from various BARC surveys and many analyst interactions, vendor portfolios are evaluated against various criteria, including the functional breadth of the product portfolio, architecture, sales and marketing strategy, financial metrics, and customer satisfaction.

Market Leaders and Product Sets for Financial Performance Management

The BARC Score analyzes the strengths and weaknesses of all leading providers. In addition to using a modern FPM platform, organizations should pursue a well-founded FPM strategy that goes beyond mere architectural design and includes non-technical, business requirements and alignment with the overall company strategy. The shift in FPM strategies of many organizations toward unified FPM processes, cloud-based implementations, self-service in finance and controlling departments, and AI and ML-supported decision-making is also reflected in the latest features of leading software platforms.

BARC Score Financial Performance Management 2024 examines and evaluates the product portfolios of 15 international software vendors: Anaplan, Board, IBM, insightsoftware, Jedox, LucaNet, OneStream Software, Oracle, Planful, Prophix, SAP, Unit4, Vena Solutions, Wolters Kluwer | CCH Tagetik and Workday.

“In a rapidly changing economic landscape, it’s crucial for companies not only to efficiently design their financial processes but also to strategically align them to ensure sustainable success. This BARC Score offers an indispensable guide to identifying the most powerful solutions that enable companies to precisely control their financial performance and plan proactively. With this analysis, we set a new standard for the selection and implementation of FPM software systems that meet the requirements of modern financial management,” said Dr. Christian Fuchs, Senior Analyst at BARC.

Challenges and Key Factors in the Digital Era

Digitalization poses new challenges for organizations. New business models have made many markets more dynamic and disruptive. Globalization and cross-border value chains have significantly expanded the scope of control of international business activities and various business models. As a result, controlling and forecasting financial targets as part of FPM is becoming increasingly important. In recent years, many companies have painfully recognized the significance of transparency in financial processes for efficient management. This transparency involves not only looking back at the past but increasingly also anticipating future developments. The core areas that companies are currently pursuing in FPM include:

- Accelerated provision of information for decision-makers.

- Increasing consideration of internal and external data for decision-making processes.

- Enhanced use of data and analysis in decision-making and management processes.

- Shorter-term planning and forecasting with higher update frequency.

- Digitalization and increased software support of internal processes as a crucial basis for their optimization and further automation.

Support from modern and requirement-oriented software solutions is an essential element to achieve these goals. Integrating various FPM disciplines into unified software platforms helps avoid problems and user dissatisfaction, optimize financial management processes within companies, and advance the digital transformation of the office of finance.

Find the BARC Score Financial Performance Management 2024 here