Survey Uncovers Potential Boom in the Financial Consolidation Software Market

Würzburg, March 14, 2024: BARC has released the first edition of “The Financial Consolidation Survey 24”, a comprehensive study based on feedback from 531 participants. The survey offers valuable insights into the financial consolidation and group accounting software market.

Unlike traditional market research, this survey relies on factual data and detailed quantitative analysis rather than anecdotal evidence or subjective opinions. Its goal is to understand current market trends, the decision-making process behind purchasing financial consolidation tools, their application, the challenges users face, and their overall success rate.

The survey encompasses nine financial consolidation and group accounting products from seven different vendors, ranging from industry giants such as IBM, Oracle and SAP to more specialized vendors like CCH Tagetik, insightsoftware/IDL, OneStream Software and LucaNet.

Challenges and problems with products

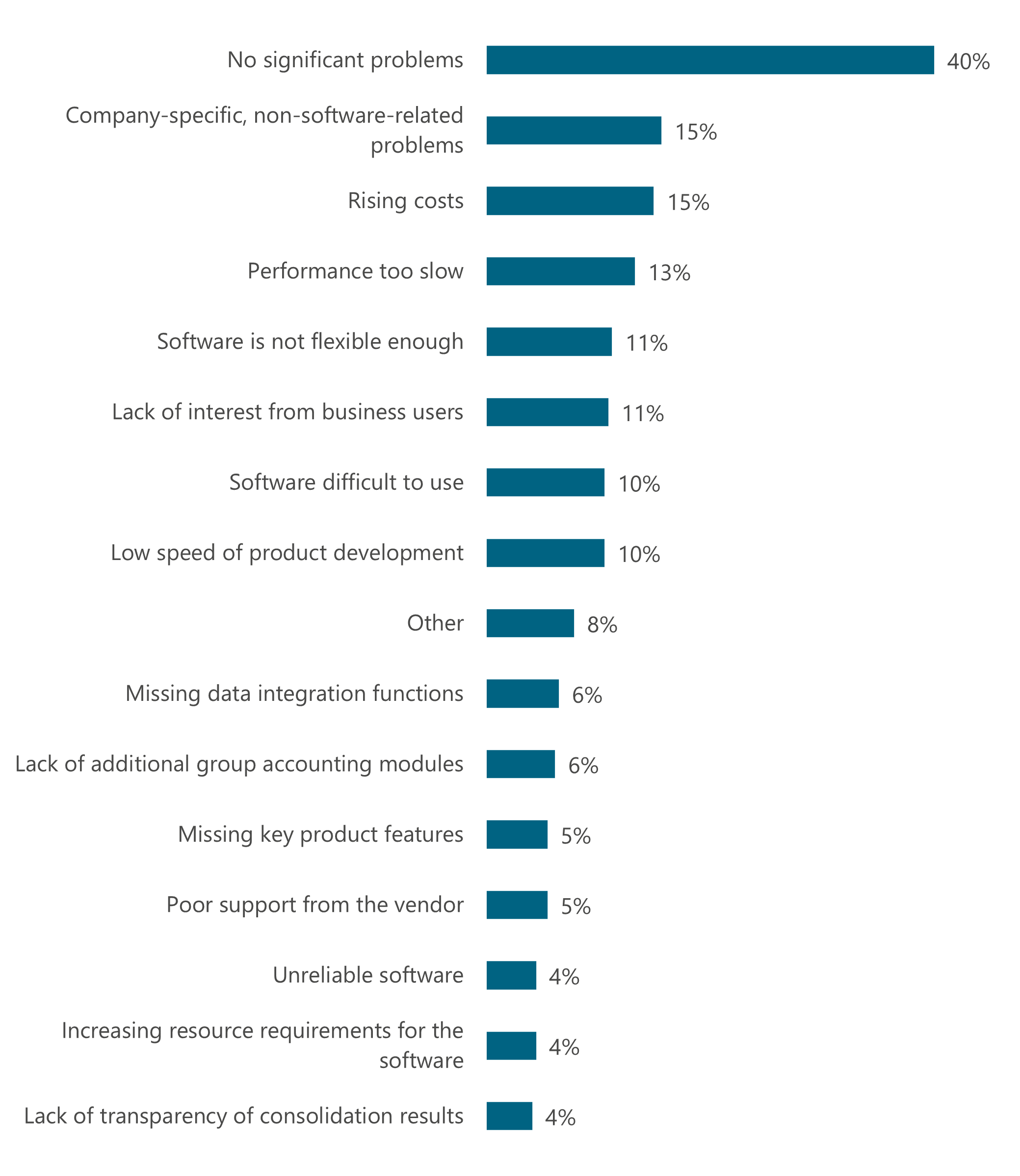

In terms of problems experienced, beside the rising cost of applications, product-related issues play the most important role: Slow performance, inflexibility and low speed of product development are critical issues reported by users (see figure 1).

Figure 1: What, if any, are the most serious problems your business users have encountered in the use of the product? (n=298)

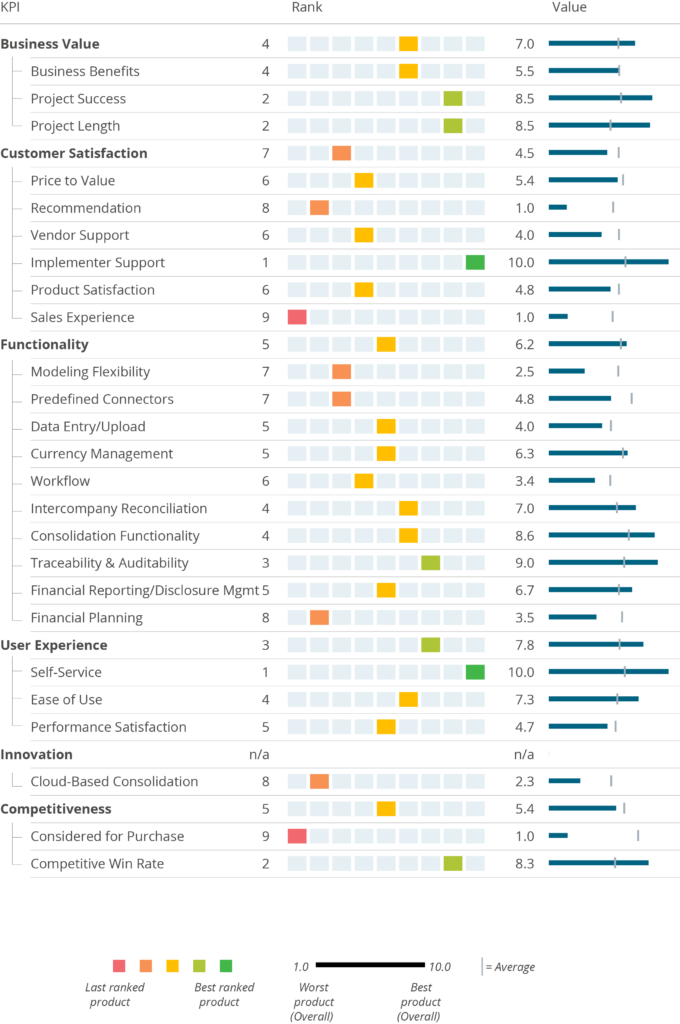

The survey findings indicate a greater diversity of strengths and weaknesses profiles among financial consolidation tools compared to those observed in the corporate planning market. The selection of the right financial consolidation provider therefore has an even bigger influence on the success of the project than in the case of planning.

Legacy systems need replacing

One of the survey’s significant findings is that a considerable segment of the market (31% of respondents) uses solutions that are at least 10 years old. This indicates a potential wave of renewal as organizations look to replace legacy systems.

“The survey shows that we can expect a wave of legacy system replacements in the short run. Many organizations rely on solutions that are outdated. Comparative data from our annual Planning Survey tells us that the average age of planning solutions is much lower,” said Stefan Sexl, BARC Fellow and co-author of the report.

Figure 2: Sample product profile based on the survey results

More integrated group accounting solutions

Interestingly, 41% of participants are exploring additional functionalities like ESG and tax reporting, highlighting a trend toward more integrated digital finance solutions.

“This indicates a move away from isolated solutions to a more cohesive approach to group accounting processes,” Sexl observed. “We see a good portion of software selections in this area integrating additional requirements like ESG, tax and account reconciliation.”

“It was also interesting to see that the number of companies where one integrated department takes responsibility for planning, consolidation and reporting is quite high at 42%. Companies increasingly see CPM solutions not only as an integrated package from a technical point of view, but also organizationally.”

The Financial Consolidation Survey 24 is a critical resource for organizations looking to navigate the complexities of financial consolidation and group accounting software. It provides a unique perspective on the market, informed by real-world user experiences, to help decision-makers choose the most effective tools for their needs.

Comparison of the Best Financial Consolidation Tools in 2024