About The Data Management Survey

One of the most extensive data management surveys in the world. Learn what over 900 users think about data management products and uncover the latest trends that matter for your data management today.

The Data Management Survey, now in its sixth year, is a BARC research study focused on the data management tools market. Our research is primarily based on a major survey of 909 participants worldwide, and provides a wealth of user feedback on 23 of the leading data management solutions on the market today.

Our user survey covered issues ranging from the selection and purchase of software through to deployment and use, including questions about the success of software projects, the usability of each product and the challenges encountered.

The following link provides more detail on our survey methodology, the survey sample, and how we categorize and score data management tools:

Respondents

Countries

Data Management Products

Years

Components of The Data Management Survey

The findings from The Data Management Survey 25 are published across several bite-size documents (see below). These documents do not need to be read in sequence. The Results and the Vendor Performance Summaries can be read independently.

BARC also provides the raw data via a web-based tool – The Data Management Survey Analyzer – enabling users to carry out their own analysis of the survey results.

The Results

An overview and analysis of the most important product-related findings and topical results from The Data Management Survey 25.

The Analyzer

Our powerful interactive online tool, enabling you to perform your own custom analysis of the full survey data set.

Vendor Performance Summary

A series of executive reports on each product featured in The Data Management Survey 25. Each report contains a vendor and product overview by BARC’s analyst team plus all the relevant product-related results from The Data Management Survey.

Sample & Methodology

Much of the value of The Data Management Survey lies in the large number and distribution of survey responses. With a sample of 909 responses, it is among the largest independent surveys into this topic in the world.

The Data Management Survey 25 comprises a total of 3 sub-surveys, all of them with a unique functional focus:

- The Cloud Data Platforms Survey 25

- The Data Intelligence, Catalogs and Marketplaces Survey 25

- The Data Product Engineering Tools Survey 25

Each survey compares products that offer functionality in that particular area. If a product offers features for two or even all three of these areas, it will be featured in all the applicable surveys.

Overall, this concept enables a more precise allocation of products to their respective functional usage areas, allowing for better comparability between specific product groups. In addition to this differentiation, we have also created peer groups for each sub-survey to provide a more detailed analysis of certain functional product categories. For further information, please refer to the “Peer groups” section below.

The KPI calculation is performed across all products and is therefore independent of the sub-survey and peer group allocation. This approach provides an absolute rating scale for all products, ranging from 1 (worst) to 10 (best). These absolute ratings can then be applied comparatively to specific product groups based on the sub-survey and peer group allocation. For further information on KPI calculation, please take a look at chapters “Overview of the key calculations in The Data Management Survey 25” and “Understanding the KPIs” in our “Sample & Methodology” PDF.

This section describes the characteristics of the people who took part in the study, including information on the type, company size and industry sector of participants.

Sample size and make-up

Many thousands of people were invited to take part in The Data Management Survey 25 using a range of media.

A summary of the online data collected is shown in the table, with the number of responses removed also displayed.

Our data cleansing rules are thorough and involve several different tests. All fraudulent or suspect data that purports to be from bona fide data management software users is removed.

The number of responses is divided between users, consultants and vendors. The questionnaire for vendors contains a different set of questions to those answered by users and consultants.

| Responses removed from the samples | Responses |

|---|---|

| Total responses | 909 |

| Removed during data cleansing | 108 |

| Total answering questions | 801 |

| Total responses analyzed | Responses |

|---|---|

| Users | 526 |

| Consultants | 163 |

| All users | 689 |

| Vendors/Resellers | 85 |

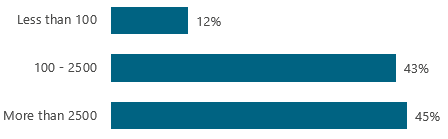

Organization sizes by headcount

Data management products are mostly found in mid-sized and large organizations, a fact reflected in the high percentage of responses we received from users in companies with more than 100 employees.

Participants from smaller companies (i.e., with less than 100 employees) formed the smallest grouping with 12% of the total number of responses.

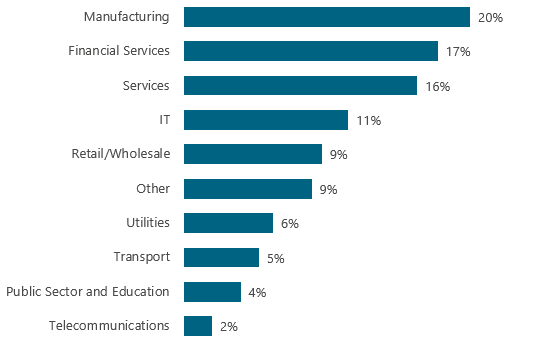

Vertical markets

The chart on the right shows the breakdown of survey responses by industry sector. It only includes respondents who answered product-related questions in the survey (i.e., users and consultants).

Manufacturing comes out on top – as it has in previous years – with 20% of the sample.

Data Management Products in The Data Management Survey

We require at least 18 user reviews for the survey results of any data management product to be analyzed in detail. 23 data management tools reached this threshold in this year’s Data Management Survey.

When grouping and describing the data management solutions featured in The Data Management Survey, we do not always follow the naming conventions the vendors use to the letter. The names we use are sometimes abbreviated and are not always the official product names used by the vendors at the time of publication.

We asked respondents explicitly about their experiences with products from a predefined list, with the option to nominate other products. This list is updated each year and is based on the sample size of the products in the previous year, as well including new entrants to the data management market.

Where respondents said they were using an ‘other’ product, but from the context it was clear that they were actually using one of the listed products, we reclassified their data accordingly.

The table to the right shows the data management products included in our detailed analysis.

| Product name | Respondents |

|---|---|

| 2150 Datavault Builder | 20 |

| Alation Data Intelligence | 20 |

| Amazon Redshift | 20 |

| AnalyticsCreator | 19 |

| Collibra Data Intelligence Platform | 21 |

| Databricks Data Intelligence Platform | 24 |

| dataspot. | 30 |

| dbt Cloud | 19 |

| Dremio | 21 |

| Exasol Cloud | 20 |

| Google BigQuery | 18 |

| Idera Wherescape RED, 3D | 21 |

| Informatica Intelligent Data Management Cloud | 18 |

| Microsoft Azure Synapse | 19 |

| Microsoft Data Fabric | 19 |

| One Data | 22 |

| Qlik Data Integration | 20 |

| SAP Datasphere | 20 |

| Snowflake Cloud Data Platform | 50 |

| Synabi D-QUANTUM | 24 |

| Talend Data Fabric | 18 |

| TimeXtender | 19 |

| VaultSpeed | 19 |

The Peer Groups

The Data Management Survey 25 features a range of different types of data management tools so we use peer groups to help identify competing products. The groups are essential to allow fair and useful comparisons of products that are likely to compete.

The peer groups have been defined by BARC analysts using their experience and judgment, with segmentation based on usage scenario.

Peer groups are intended to help the reader understand which products are comparable and why there is such a disparity of findings between all the individual products. The groupings themselves make no judgment on the quality of the products. Most products appear in more than one peer group.

‘Yellow pages’ to support search for data and to support governance leveraging metadata in a highly user-friendly environment.

- Alation Data Intelligence

- Collibra DI Platform

- dataspot.

- Informatica IDMC

- Microsoft Data Fabric

- One Data

- Synabi D-QUANTUM

- Talend Data Fabric

Data catalog solutions that are used around the world and not just marketed in one region.

- Alation Data Intelligence

- Collibra DI Platform

- Informatica IDMC

- Microsoft Data Fabric

- Talend Data Fabric

Platforms that support search & discovery, data governance, data collaboration and data access & marketplaces through the automated integration, preparation and analysis/use of metadata.

- Alation Data Intelligence

- Collibra DI Platform

- Databricks DI Platform

- dataspot.

- Informatica IDMC

- Microsoft Data Fabric

- One Data

- Qlik Data Integration

- SAP Datasphere

- Snowflake CDP

- Synabi D-QUANTUM

- Talend Data Fabric

Platforms mainly used as enterprise solutions in complex scenarios with more than 500 users, providing access to metadata from various sources.

- Alation Data Intelligence

- Collibra DI Platform

- Databricks DI Platform

- dataspot.

- Microsoft Data Fabric

- SAP Datasphere

- Snowflake CDP

Tools mainly used in smaller scenarios, often dedicated to a specific use case or department (e.g., for search & discovery or data governance use cases).

- Informatica IDMC

- One Data

- Qlik Data Integration

- Synabi D-QUANTUM

- Talend Data Fabric

Data intelligence platform solutions that are marketed and used around the world, and not focused on just one region.

- Alation Data Intelligence

- Collibra DI Platform

- Databricks DI Platform

- Informatica IDMC

- Microsoft Data Fabric

- Qlik Data Integration

- SAP Datasphere

- Snowflake CDP

- Talend Data Fabric

Platforms that manage and provide data for analytical purposes as a service in the cloud. Many offerings also encompass advanced functionality for data integration, access and even analysis.

- Amazon Redshift

- Databricks DI Platform

- Dremio

- Exasol Cloud

- Google BigQuery

- Microsoft Azure Synapse

- Microsoft Data Fabric

- SAP Datasphere

- Snowflake CDP

Tools that support various integration patterns to get data connected and make it usable for analytical and business purposes.

- 2150 Datavault Builder

- AnalyticsCreator

- Databricks DI Platform

- dbt Cloud

- Dremio

- Idera Wherescape

- Informatica IDMC

- Microsoft Data Fabric

- One Data

- Qlik Data Integration

- SAP DatasphereSnowflake CDP

- Talend Data Fabric

- TimeXtender

- VaultSpeed

Data product engineering solutions that are marketed and used around the world, and not focused on just one region.

- Databricks DI Platform

- dbt Cloud

- Dremio

- Idera Wherescape

- Informatica IDMC

- Microsoft Data Fabric

- Qlik Data Integration

- SAP Datasphere

- Snowflake CDP

- Talend Data Fabric

- TimeXtender

- VaultSpeed

Tools to automate data or requirements-driven data warehouse or data lake design and implementation.

- 2150 Datavault Builder

- AnalyticsCreator

- Idera Wherescape

- Qlik Data Integration

- TimeXtender

- VaultSpeed

Tools to support the extract, transform, load (ETL/ELT) process of data from sources to analytical targets such as cloud data platforms, data warehouses and data lakes.

- dbt Cloud

- Informatica IDMC

- Microsoft Data Fabric

- Qlik Data Integration

- SAP Datasphere

- Talend Data Fabric

The KPIs

The KPIs are designed to help the reader spot winners and losers in The Data Management Survey 25 using well-designed dashboards packed with concise information. There is a set of 26 normalized KPIs (which we refer to as ‘root’ KPIs) for each of the 23 products, as well as 5 aggregated KPIs based on aggregations of various combinations of ‘root’ KPIs.

A set of KPIs has been calculated for each of the eleven peer groups. The values are normalized according to the whole sample.

The KPIs all follow these simple rules:

- Only measures that have a clear good/bad trend are used as the basis for KPIs.

- KPIs may be based on one or more measures from The Data Management Survey.

- Only products with samples of at least 15 – 20 (depending on the KPI) for each of the questions that feed into the KPI are included.

- For quantitative data, KPIs are converted to a scale of 1 to 10 (worst to best).

- A linear min-max transformation is applied, which preserves the order of, and the relative distance between, products‘ scores.

KPIs are only calculated if the samples have at least 15 – 20 data points (this varies depending on the KPI) and if the KPI in question is applicable to a product. Therefore some products do not have a full set of root KPIs.

| Aggregated KPIs | Root KPIs |

|---|---|

| Business Value |

Business Benefits Project Success Project Length |

| Competitiveness |

Considered for Purchase Competitive Win Rate |

| Customer Satisfaction |

Product Satisfaction Vendor Support Implementer Support Price to Value Recommendation Sales Experience Time to Market Product Enhancements Partner Ecosystem |

| Technical Foundation |

Performance Platform Reliability Connectivity Scalability Extensibility Ecosystem Integration AI Support |

| User Experience |

Develop. & Content Creation Ease of Use Deployment & Operations Functional Coverage Adaptability |