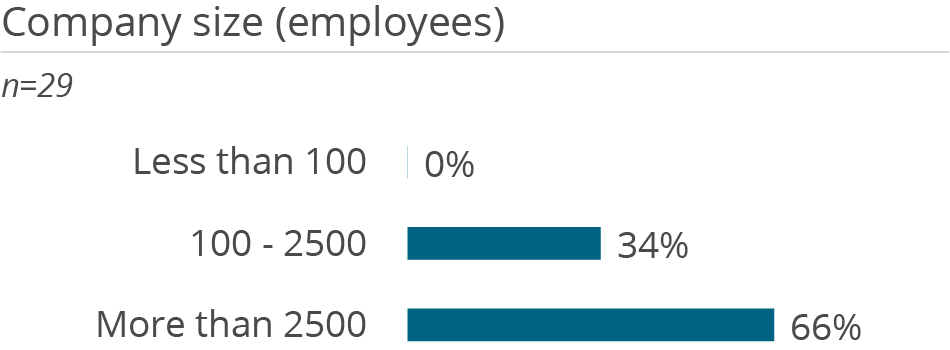

Number of employees

Industry

Source

What do you like best?

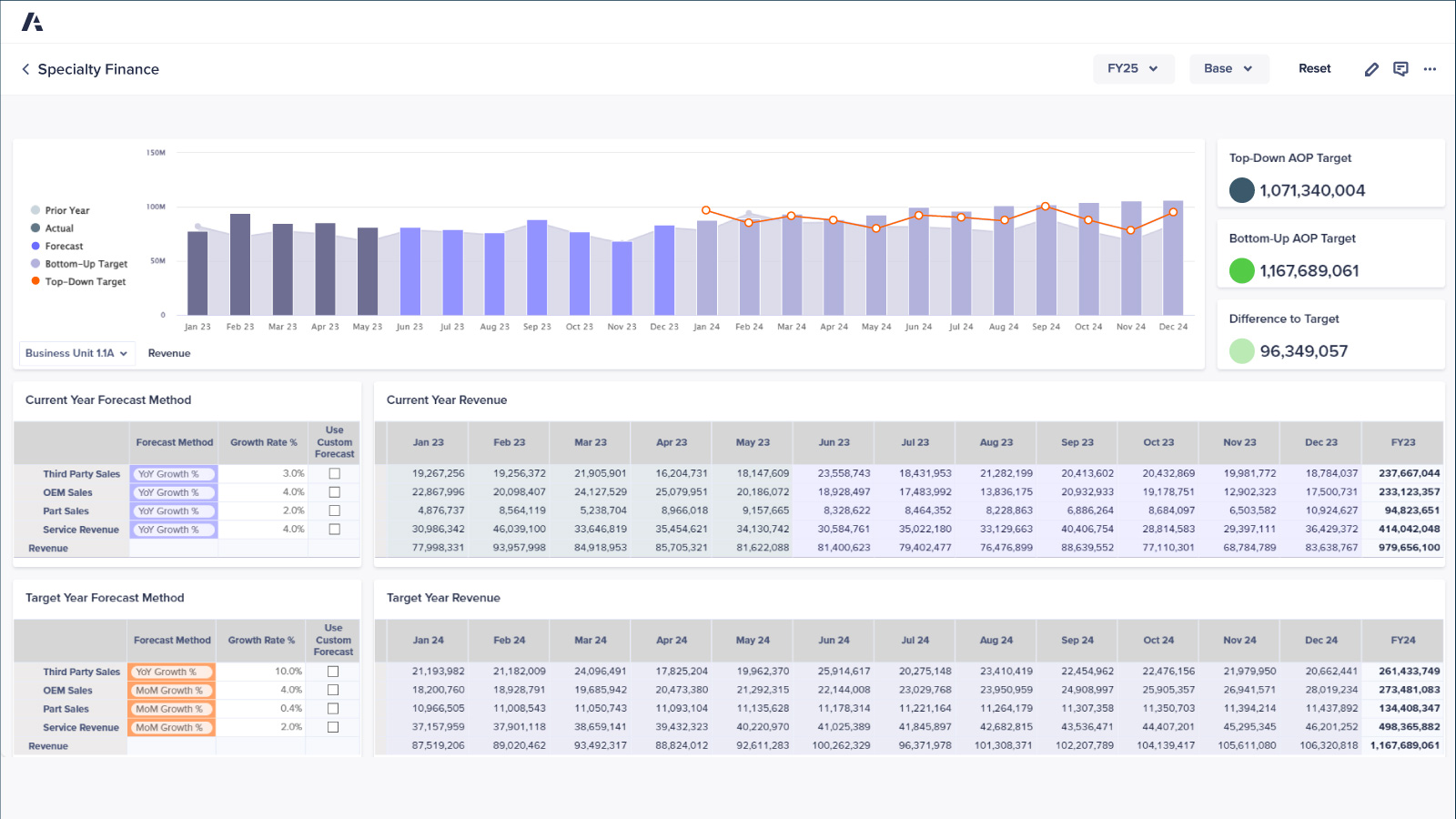

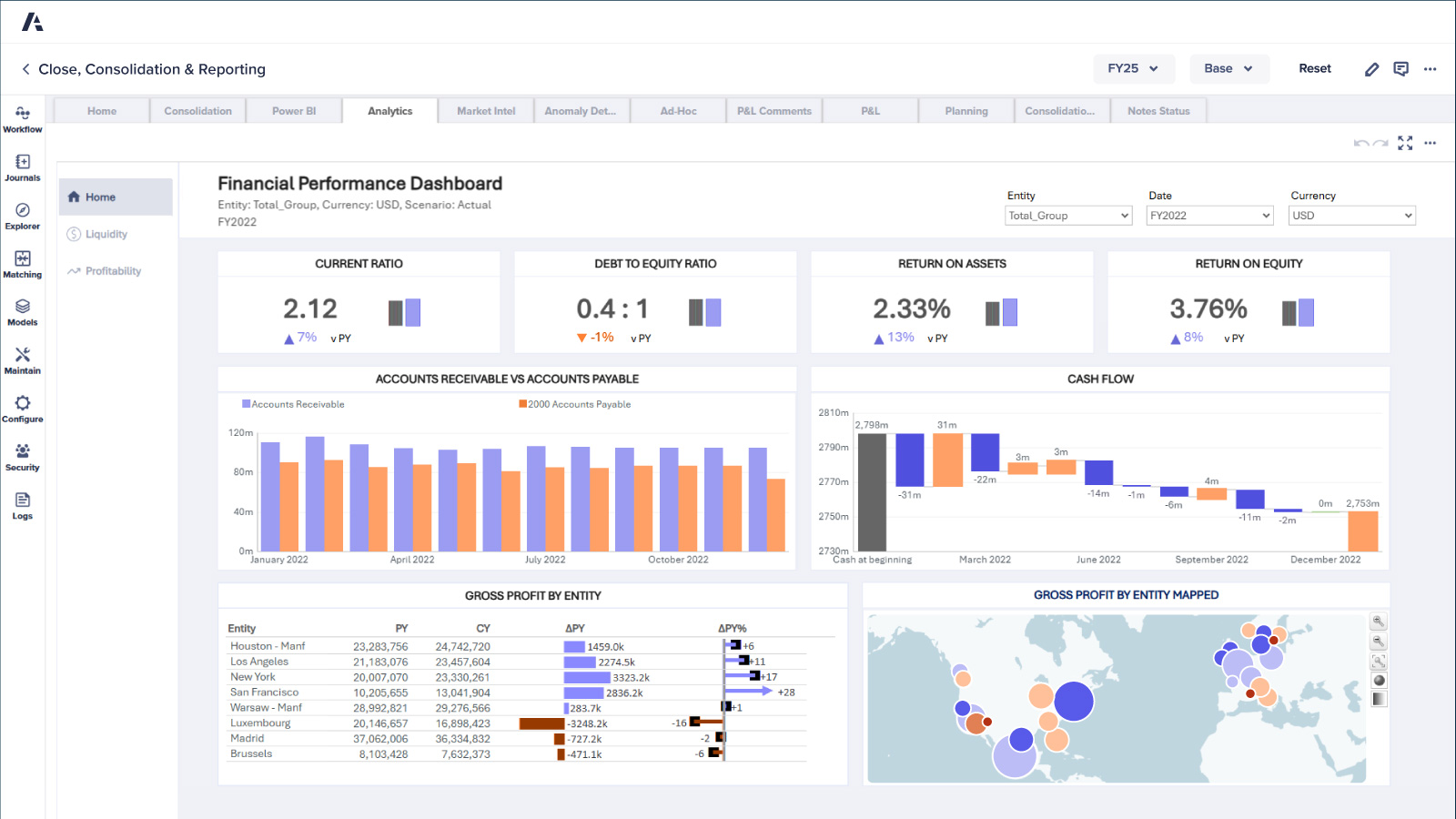

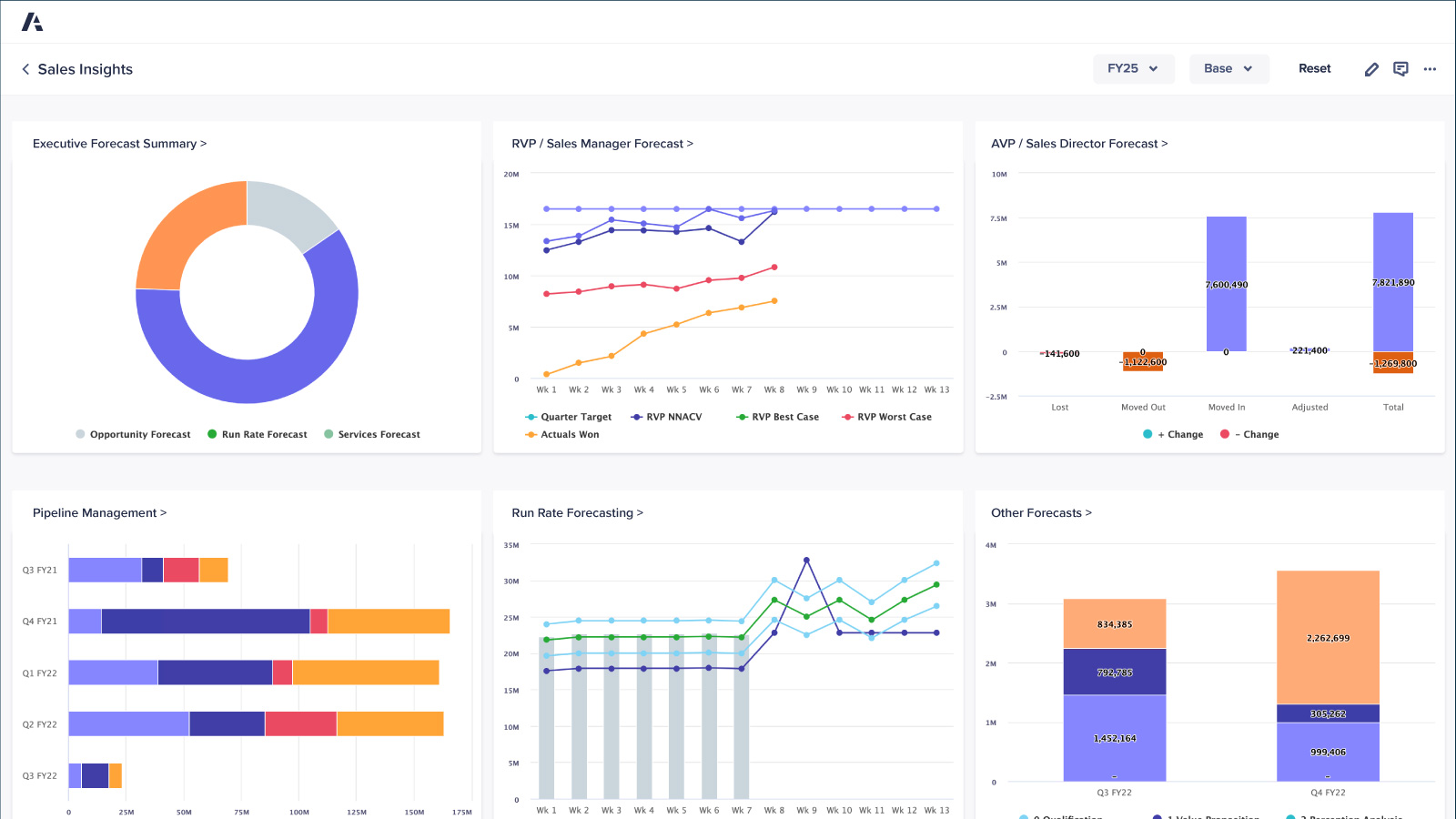

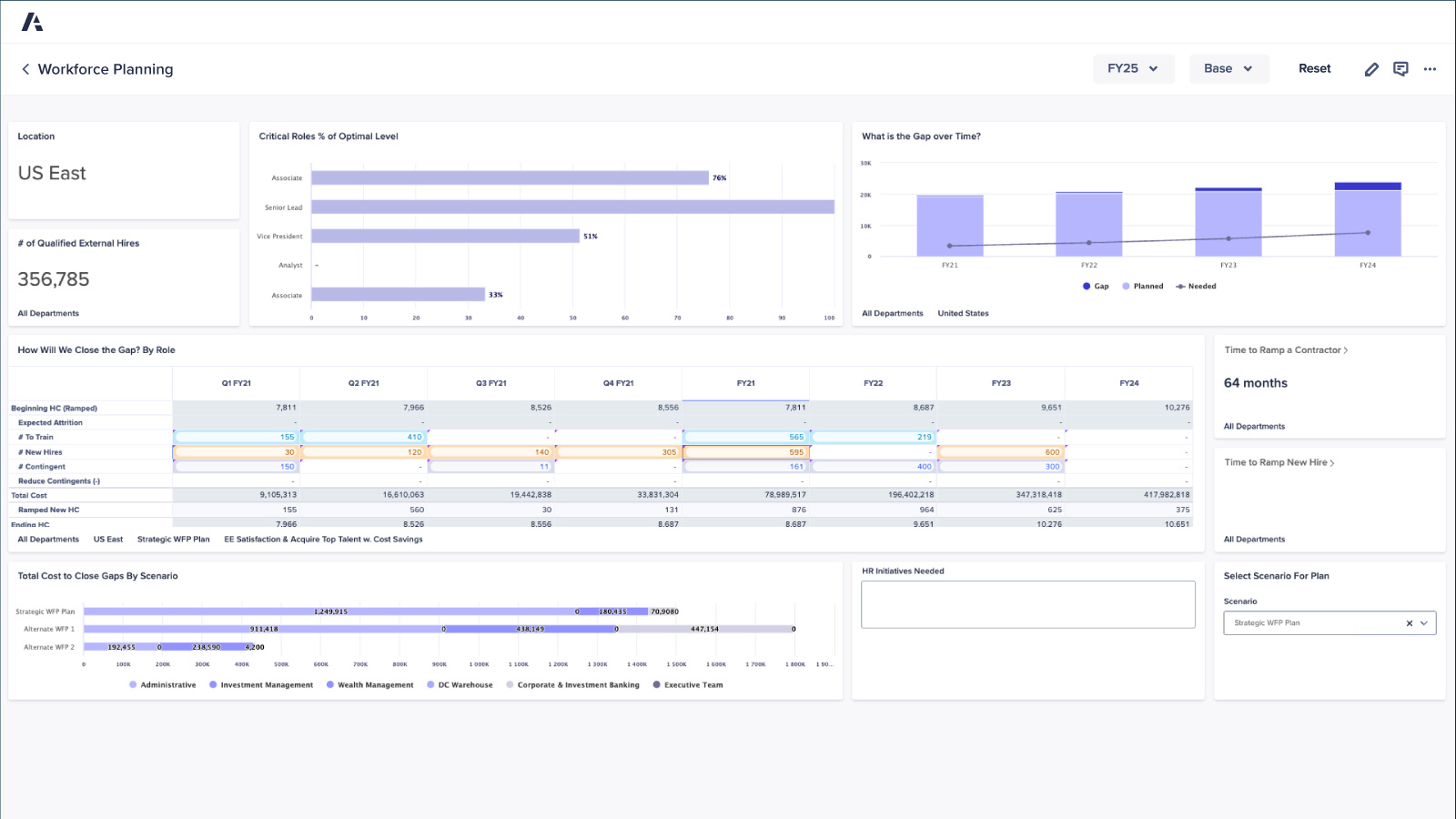

What I like most about Anaplan is its real-time, connected planning. It allows teams across Finance, HR, and Supply Chain to collaborate on a single live model, ensuring everyone works from a shared source of truth. The platform’s what-if scenario modeling is also a game-changer, enabling quick analysis of best-case, worst-case, and custom scenarios. Its No-Code, user-friendly interface empowers non-technical users to create and maintain complex models without needing IT support. Finally, Anaplan’s dynamic dashboards provide instant visual insights for better decision-making.

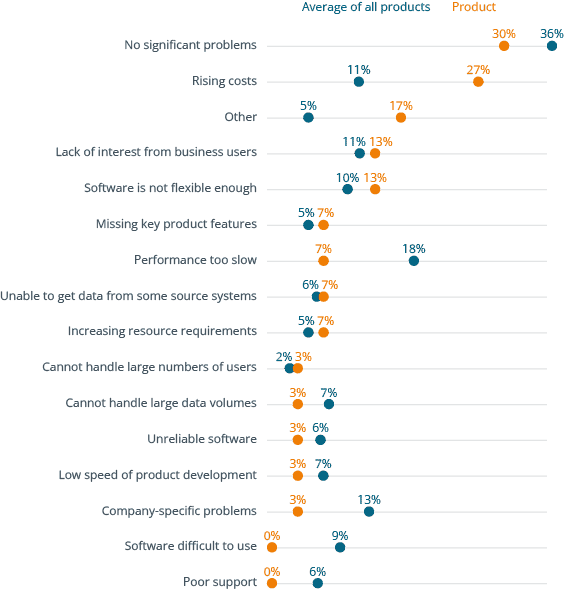

What do you like least/what could be improved?

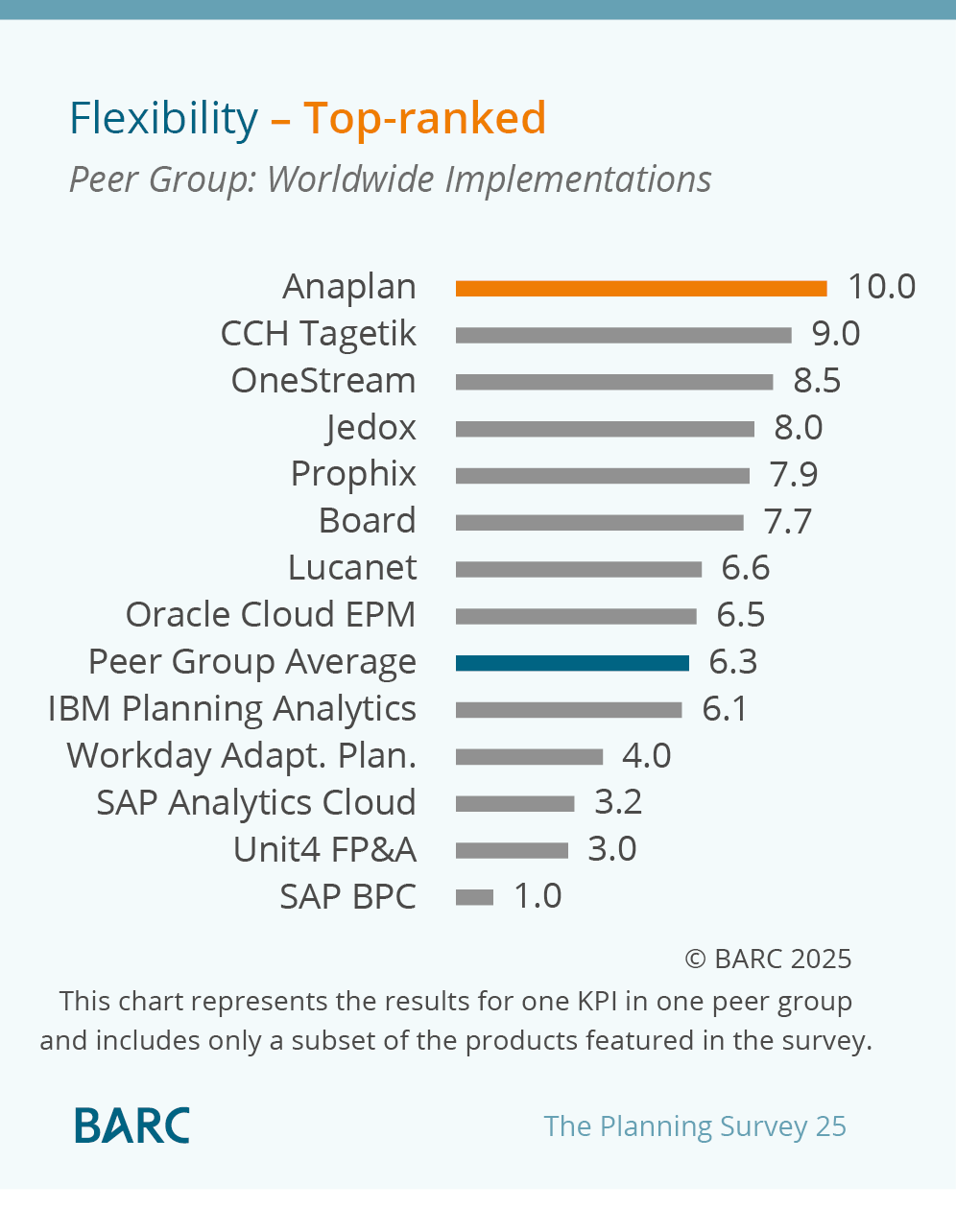

Limitation is performance on large datasets. When working with millions of data points, especially in Supply Chain Forecasting, the system can slow down significantly. Anaplan has introduced some HyperModel capabilities to address this, but performance improvements are still needed. Lack of native AI/ML features: Competitors like SAP Analytics Cloud have stronger AI-driven insights. No native version control: If a change is made in the model, there’s no simple "undo" button. Limited pre-built templates: Unlike competitors, Anaplan requires users to build many processes from scratch.

What key advice would you give to other companies looking to introduce/use the product?

A key piece of advice is to start small and scale up. Don’t try to build a full end-to-end system in one go. Focus on a critical use case, such as Budgeting or Sales Forecasting, and then expand as users become more comfortable. This also allows you to prove ROI early in the process. It’s also essential to engage stakeholders early. Since Anaplan is a collaborative platform, ensure that representatives from Finance, HR, and Supply Chain are involved in model design from the start. This prevents silos and helps create a shared system that works for everyone. Lastly, I recommend working with an Anaplan consultant or partner during the initial phase. They can help you avoid common pitfalls and accelerate the design process. Once you have a firm foundation, your internal team can take control of the system.

How would you sum up your experience?

Overall, I think Anaplan is an industry-leading tool for Connected Enterprise Planning. It’s ideal for companies that want to move beyond Excel and adopt dynamic, real-time planning. The ability to create customized models for Finance, HR, and Supply Chain, all within the same platform, is a huge advantage. I’ve seen firsthand how it helps teams collaborate in real time. For example, we no longer need to chase down multiple Excel files across departments - everything happens in one shared model.