insightsoftware IDL

What is insightsoftware IDL?

Software for financial corporate management with integrated applications for group consolidation, financial planning, operational planning, management reporting, regulatory reporting and analysis

About insightsoftware IDL

The information in this section has been provided by the vendor of insightsoftware IDL.

Self-description of the vendor

insightsoftware is a global provider of comprehensive solutions for the Office of the CFO. We believe an actionable business strategy begins and ends with accessible financial

data. With solutions across financial planning and analysis (FP&A), accounting, and operations, we transform how teams operate, empowering leaders to make timely and informed decisions. With data at the heart of everything we do, insightsoftware enables automated processes, delivers trusted insights, boosts predictability, and increases productivity. Learn more at insightsoftware.com

insightsoftware IDL videos

Mit dem Laden des Videos akzeptieren Sie die Datenschutzerklärung von YouTube.

Mehr erfahren

Mit dem Laden des Videos akzeptieren Sie die Datenschutzerklärung von YouTube.

Mehr erfahren

Would you like to find out more about BARC reviews? Our FAQs answer the most important questions.

Case studies from this vendor

insightsoftware IDL BARC Review & Rating

This section contains our independent analyst views on insightsoftware IDL.

Provider and product description

insightsoftware is a US-based global provider of solutions for the office of the CFO backed by private equity investors Hg, TA Associates and Genstar Capital. The company employs more than 2,600 people worldwide and serves over 34,000 customers with more than 500,000 active users in 150 countries. insightsoftware was formed in 2018 through the merger of Hubble and Global Software, Inc. The vendor’s rapid growth in recent years has been largely driven by acquisitions. In enterprise performance management (EPM), the key vendors acquired by segment include Bizview, Calumo, Fiplana, JustPerform, Longview, Power ON and others (planning, budgeting and forecasting); Clausion, IDL, JustPerform, Longview, Viareport and others (financial close and consolidation); Certent and others (disclosure management and regulatory reporting); and CXO, Logi Analytics and others (BI). This strategy has resulted in a broad portfolio of software solutions for finance, accounting, and data and analytics.

insightsoftware’s comprehensive product portfolio includes cloud and on-premises solutions for the key processes of today’s finance organizations: budgeting and planning, financial reporting, operational reporting, close and consolidation, disclosure management, ESG, tax reporting, business intelligence, analytics and data management. These solutions can be used independently or in combination and are offered to customers based on their individual needs and strategic direction (e.g., focused use cases, UI requirements, industry, global or local orientation, company size, connectivity to source systems, etc.). The overall goal is to enable the office of the CFO to turn information into insights that empower business leaders to strategically drive their organizations.

Within the DACH region, insightsoftware’s FPM go-to-market strategy is strongly focused on IDL and its professional applications. Founded in 1990, IDL was acquired in 2020, and has offices in Germany, Austria, Switzerland and France. Today, insightsoftware sees IDL’s comprehensive FPM platform as a strategic element for its future success and expansion in the DACH region and bordering countries.

IDL’s FPM suite is an integrated platform and includes modules for financial consolidation and close (IDL Konsis), financial planning (IDL Forecast), operational planning, reporting and analysis (IDL Designer) and disclosure management (IDL Publisher). Complementary solutions for financial filings and prebuilt content for specific industries and use cases are also available. IDL solutions can be deployed either in the cloud (using Microsoft Azure), on premises or in hybrid scenarios.

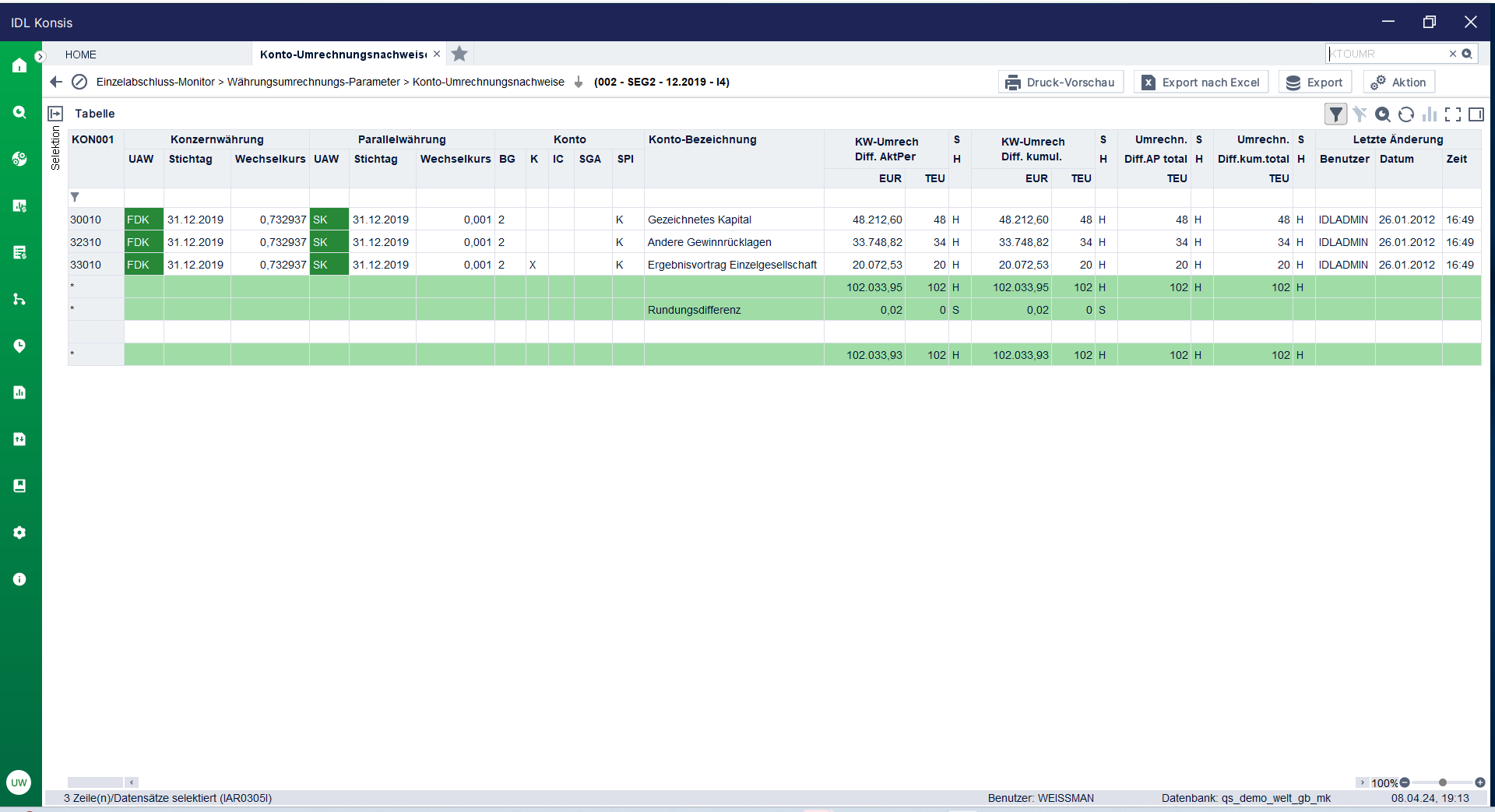

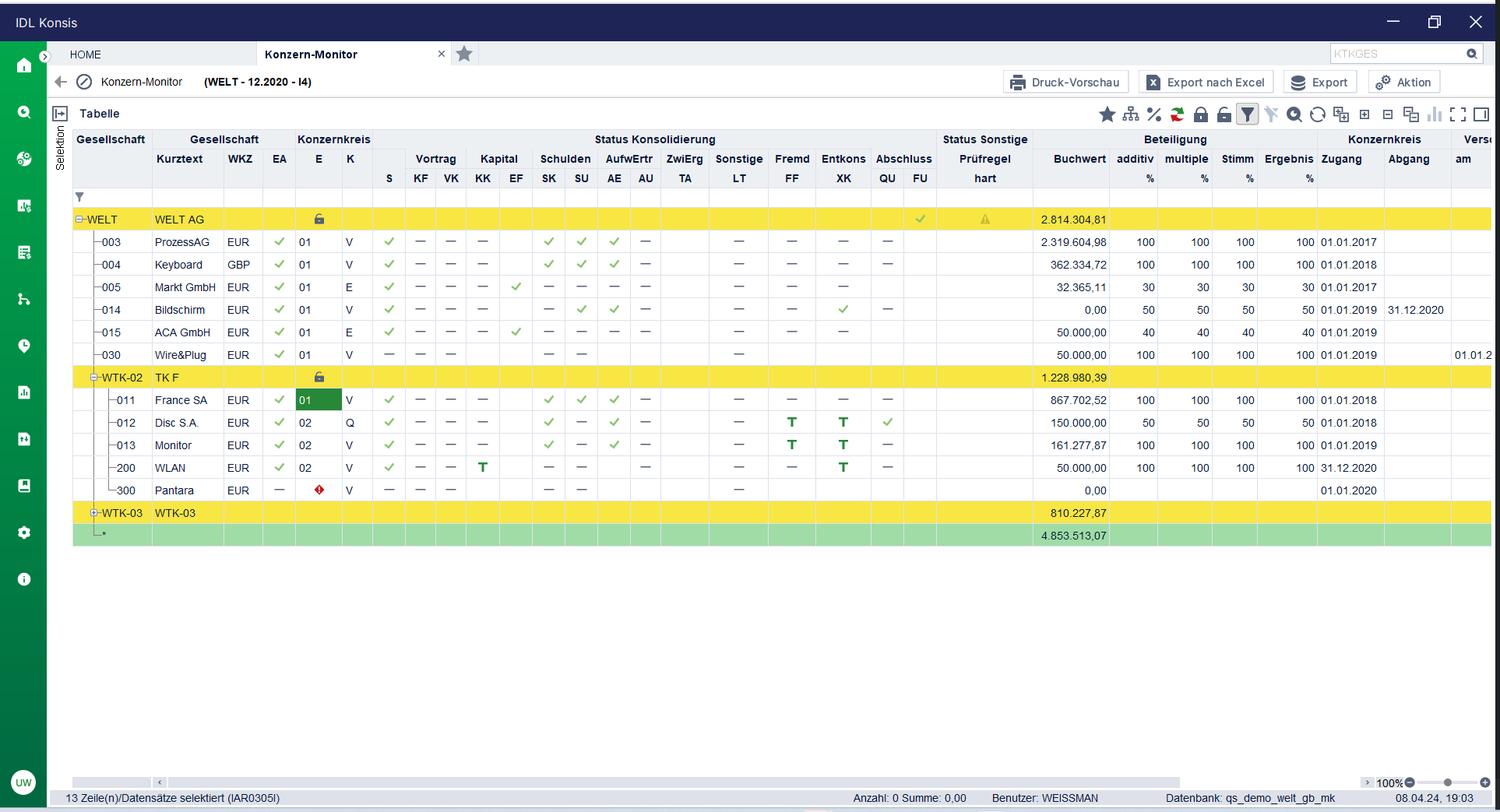

A particular strength of IDL Konsis is the comprehensive integration of details such as intercompany data and asset and equity history. Interfaces to common source systems, data input forms and Microsoft Excel-based data input forms offer a wide range of options for group head offices to receive data. Intercompany reconciliation can be carried out in the group currency, but also in the transaction currency. If implemented by the customer, it is possible to drill down to the level of single postings. Navigation within IDL Konsis is mainly via two status monitors, one for the single entity and one for the group. By defining validation rules, the consistency for harmonized data is ensured at any time. Standard reports as part of the group consolidation and close process can be created within the application, but also in Microsoft Excel using the available add-in.

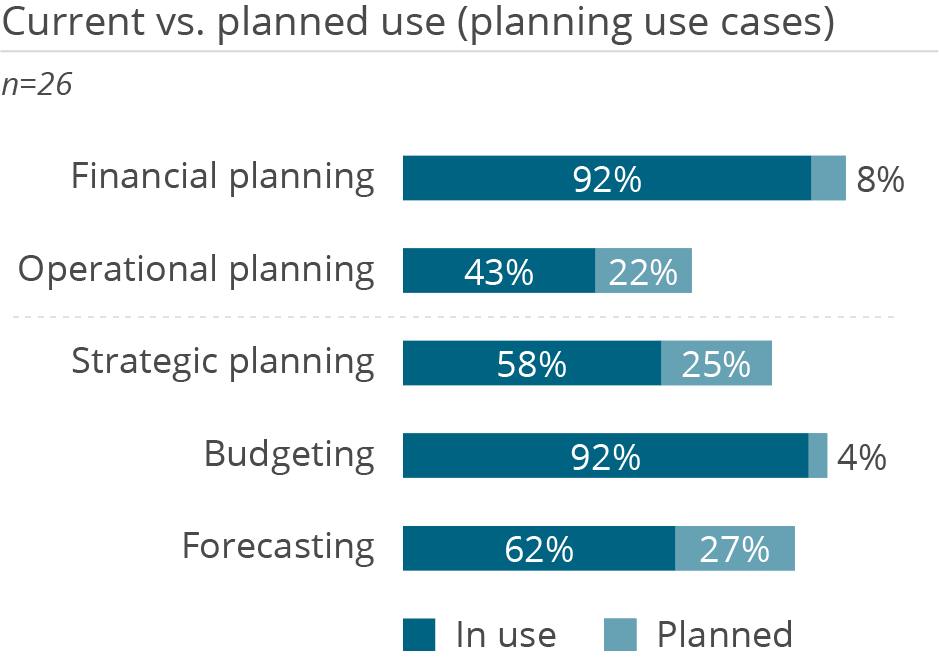

IDL supports scenarios for financial planning with IDL Forecast and for operational budgets (e.g., sales, HR, etc.) with IDL Designer. IDL Forecast is aimed at business departments, often belonging to a corporate group. Company-wide financial result plans (balance sheet, P&L, cash flow) can be created at subsidiary or group level. IDL Forecast provides a predefined financial (planning) data model with intertwined business rules, based on relational data storage. Thanks to the tight integration with IDL Konsis, it is possible to consolidate plan data (or actuals) immediately, taking into account planned intercompany allocations. IDL Konsis offers comprehensive functions for legal consolidation including intercompany reconciliation as well as management consolidation. Extensive predefined business rules for financial management are available as standard in the solution.

In addition to its operational planning functionality, IDL Designer is also the central component of IDL’s reporting platform, offering web-based functions for creating ad hoc and standard reports, OLAP analyses and dashboards. It provides a user-friendly environment for designing individual reports with custom layouts that can be organized in a report catalog.

For additional requirements not covered by IDL’s own solutions, integration with other insightsoftware applications is possible.

Strengths and challenges of insightsoftware IDL

BARC’s viewpoint on the product’s strengths and challenges.

Strengths

- insightsoftware offers a comprehensive product portfolio for the key processes of finance organizations, including budgeting and planning, financial and operational reporting, close and consolidation, disclosure management, ESG, tax reporting, business intelligence, analytics and data management. The solutions can be used independently or in combination to process data from multiple source systems.

- IDL provides an integrated platform and portfolio for financial consolidation and close, financial planning, operational planning, reporting and analytics, disclosure management and regulatory reporting that can be deployed in the cloud, on premises or in hybrid scenarios.

- Extensive predefined business rules for financial management in IDL – tight integration of financial planning and consolidation (IDW PS 880 certified). In addition, a web-based solution for operational planning is available, including comprehensive workflow and annotation functionality, ad hoc reporting and OLAP analysis with data visualization options.

- Depending on individual customer requirements, the insightsoftware portfolio offers additional applications that can be combined with IDL’s solutions, for example, via the new insightsoftware platform that connects applications, provides centralized solution access, user management, security and data access.

Challenges

- Multidimensional operational plans with IDL Designer are integrated with relational financial plans and consolidation at data level with predefined routines for data integration using ETL technologies within the underlying databases. As a result, complexity is greater due to a lag between data creation and data use, as well as different environments, modeling techniques, UIs/UXs, data integration efforts, etc.

- The implementation of complex financial management applications leveraging all IDL modules may require the help of external business consultants. However, if required, these services can be provided by insightsoftware’s team of experienced consultants or by one of the specialized consulting firms with which the vendor partners.

- Prior to being acquired, IDL was a local FPM specialist with a strong focus on its home markets in the DACH region and France. While the product’s head-to-head win rate is good, IDL’s solutions do not have the market presence to be considered for purchase worldwide. Prospects outside the DACH region with global implementation requirements should evaluate similar references and the local consulting and support capabilities of the vendor and partners.

- The breadth and constant addition of new products to the insightsoftware portfolio means that the ongoing development, integration and unification of the various portfolio components (e.g., IDL) is a resource-intensive task for the vendor and a work in progress.

insightsoftware IDL User Reviews & Experiences

The information contained in this section is based on user feedback and actual experience with insightsoftware IDL.

The information and figures are largely drawn from BARC’s The BI & Analytics Survey, The Planning Survey, The Financial Consolidation Survey and The Data Management Survey. You can find out more about these surveys by clicking on the relevant links.

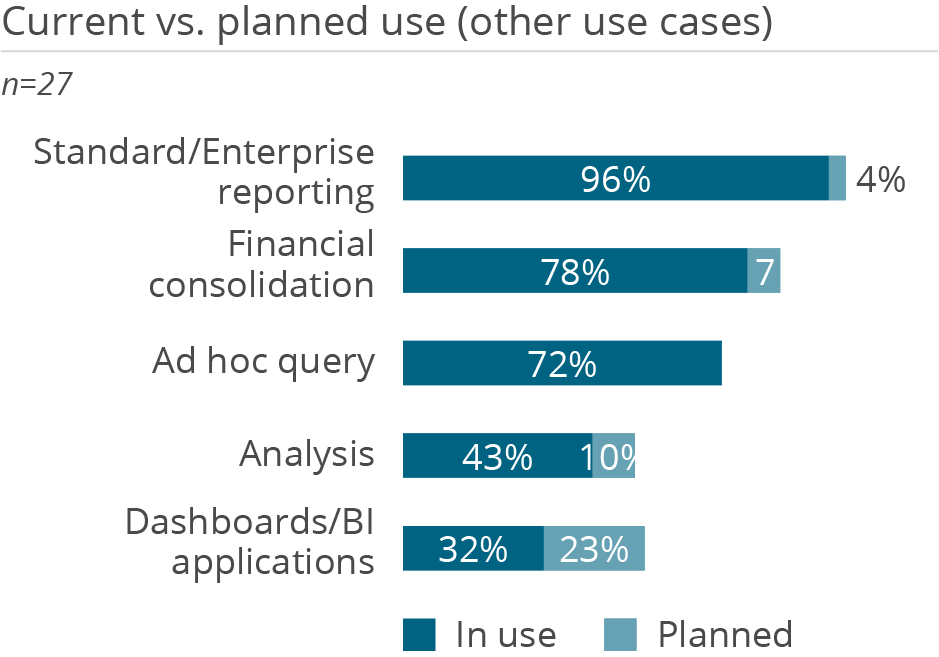

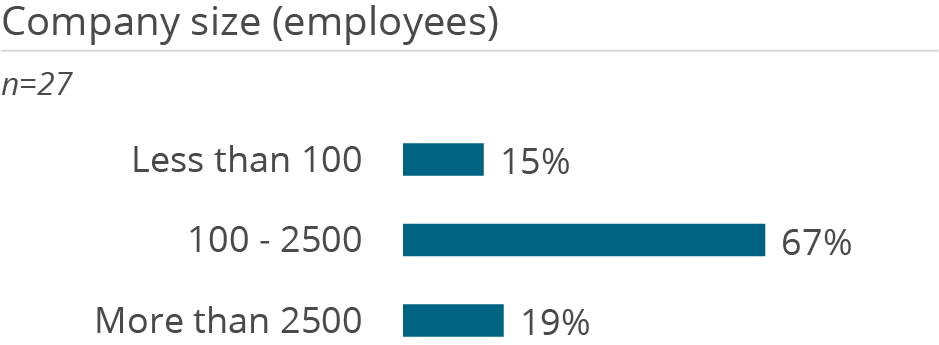

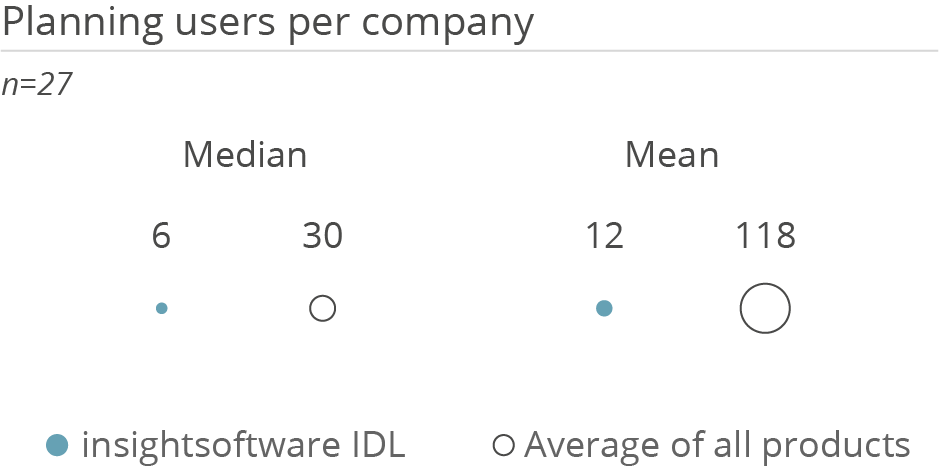

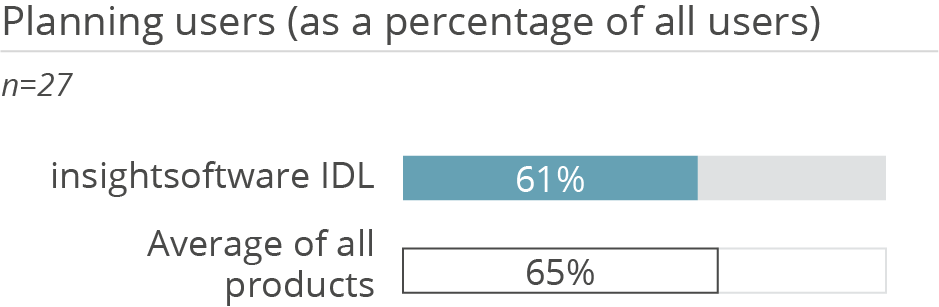

Who uses insightsoftware IDL in a planning context and how

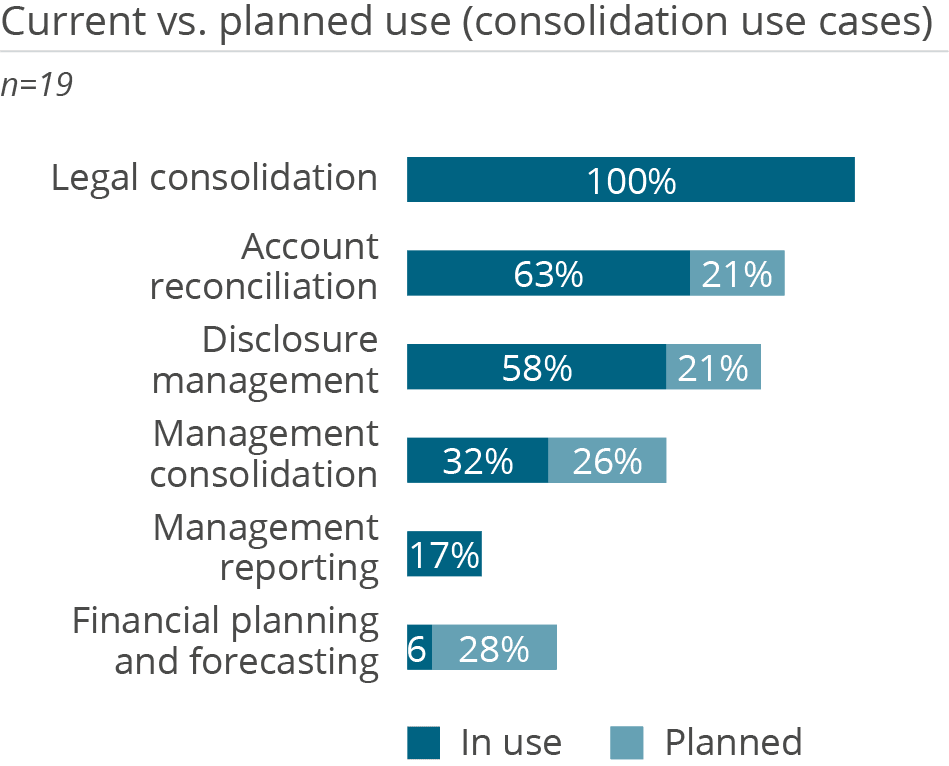

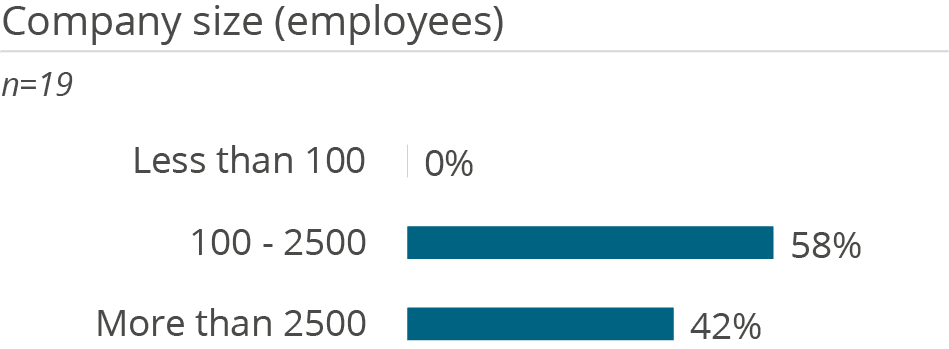

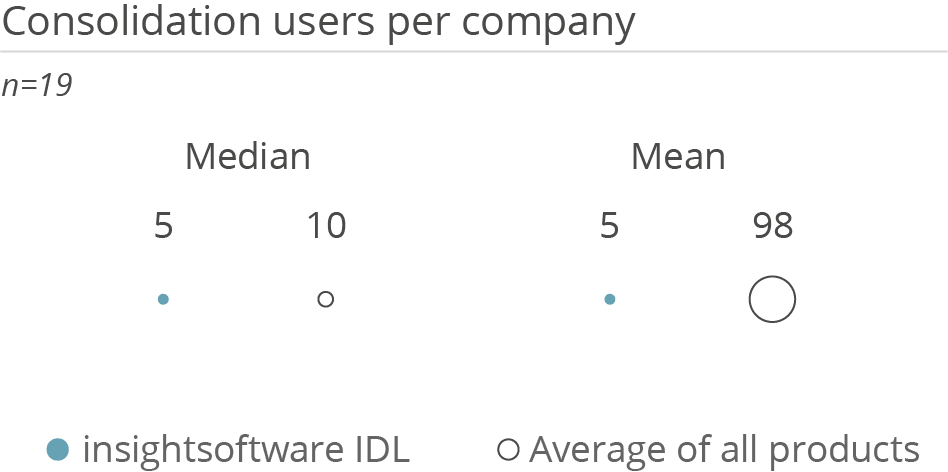

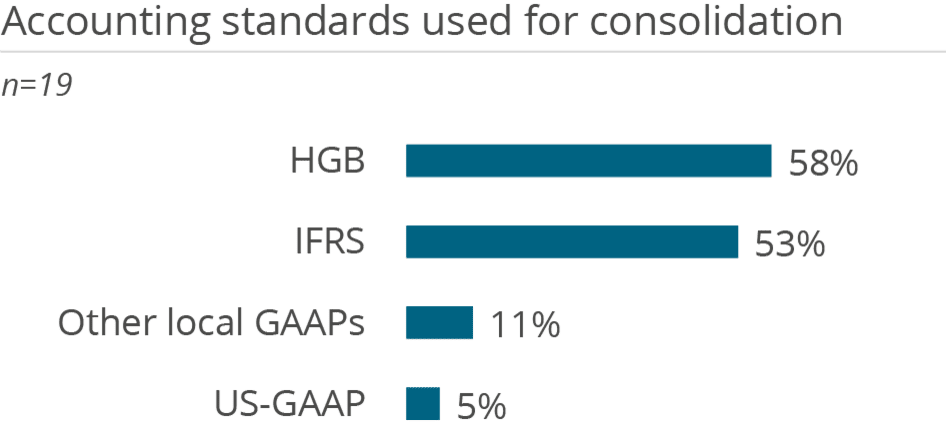

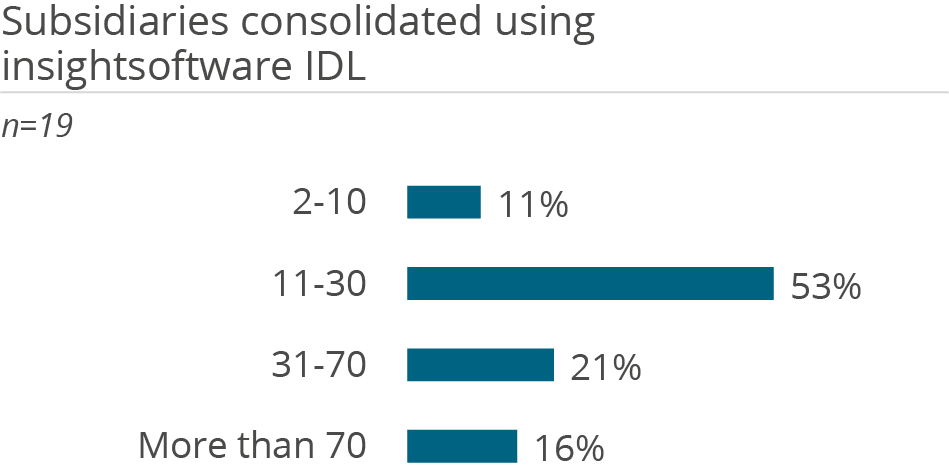

Who uses insightsoftware IDL in a financial consolidation context and how

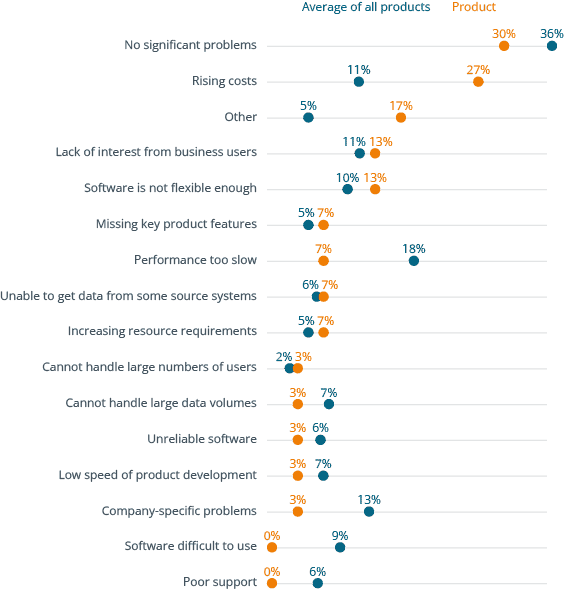

Why users buy insightsoftware IDL and what problems they have using it

- Get independent information on software solutions, market developments and trends in data, analytics, business intelligence, data science and corporate performance management.

- Make data & analytics decisions based on numbers, data, facts and expert knowledge

- Access to all premium articles and all our research, including all software comparison studies, scores and surveys.

- Unlimited access to the BARC media library

- Consume unlimited content anywhere

Full user reviews and KPI results for insightsoftware IDL

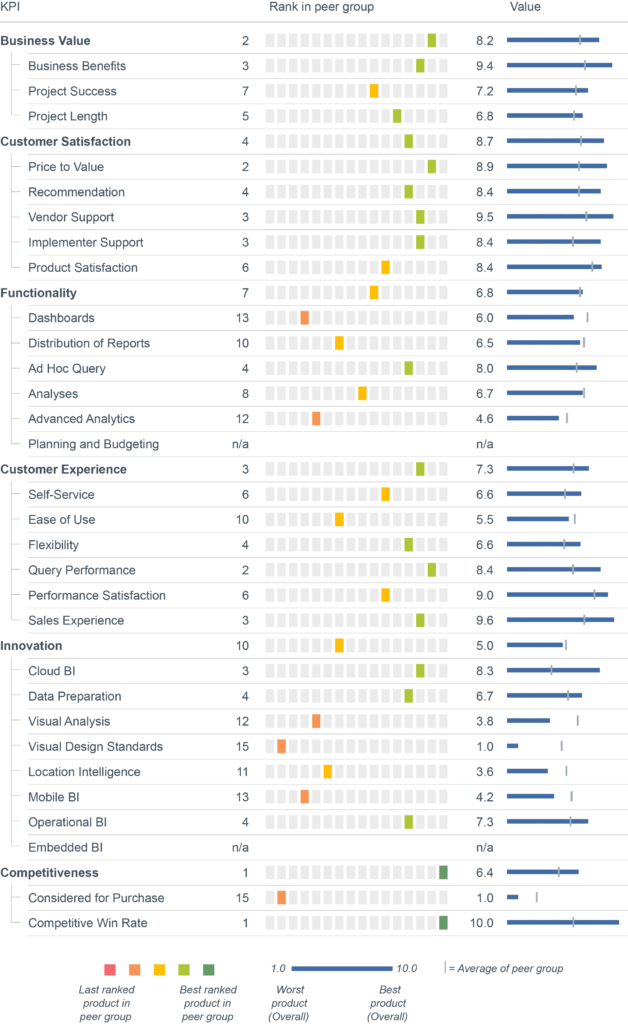

All key figures for insightsoftware IDL at a glance.

- Get independent information on software solutions, market developments and trends in data, analytics, business intelligence, data science and corporate performance management.

- Make data & analytics decisions based on numbers, data, facts and expert knowledge

- Access to all premium articles and all our research, including all software comparison studies, scores and surveys.

- Unlimited access to the BARC media library

- Consume unlimited content anywhere

Individual user reviews for insightsoftware IDL

Number of employees

Industry

Source

What do you like best?

Konsolidierungsschritte einfach zu verstehen.

What do you like least/what could be improved?

Anbindung an IDL Publisher.

What key advice would you give to other companies looking to introduce/use the product?

Gut überlegen, was nach der Konsolidierung noch gemacht werden muss, z.B. Berichte schreiben, ESEF.

How would you sum up your experience?

Guter Kontakt zu Accountverantwortlichen, nicht alle Entwicklungen positiv seit IDL zu Insightsoftware gehört, keine ausgereiften Produktlösungen.

Number of employees

Industry

Source

What do you like best?

Sehr gute Fachberaterin, die uns bei fachlichen Themen sehr gut und schnell unterstützt/berät.

What do you like least/what could be improved?

Die technische Hotline ist immer schlechter erreichbar, mit längeren Reaktionszeiten als zu Beginn (Installation im Unternehmen war 2010), bei gleichzeitig deutlich steigenden Wartungskosten! Das heißt, der Service wird schlechter, die Kosten steigen jedoch für den schlechteren Service. Das ist tatsächlich enttäuschend für uns als Kunden.

What key advice would you give to other companies looking to introduce/use the product?

Einen Prototyp vor finaler Kaufentscheidung erstellen.

How would you sum up your experience?

Die fachliche Beratung ist sehr kompetent und empfehlenswert. Die technische Unterstützung ist verbesserungswürdig! Das System ist nach einer ersten Produkt-Fachschulung wirklich in den wesentlichen Funktionen intuitiv bedienbar!

Number of employees

Industry

Source

What do you like best?

Deutschsprachige Hotline für Fachbereich und IT. Flexibilität zwischen Automatismen und manuellen Buchungen. Abbildung von Sachverhalten im Voraus möglich, nicht erst, wenn alle Kontensalden vorhanden sind.

What do you like least/what could be improved?

Ansprechbarkeit der Hotline vor dem Ticketsystem und persönlich häufige Release-Updates führen dazu, dass man in sehr kurzer Zeit out of Maintenance ist. Obwohl die Updates oft für Planung und Controlling sind und nicht im Konsolidierungsbereich, der von uns ausschließlich genutzt wird.

What key advice would you give to other companies looking to introduce/use the product?

–

How would you sum up your experience?

Sehr gutes Verhältnis mit offenen Gesprächspartnern.

Number of employees

Industry

Source

What do you like best?

Fachberatung und logisches Arbeiten.

What do you like least/what could be improved?

Einige Funktionen, die immer wieder manuell angestoßen werden müssen.

What key advice would you give to other companies looking to introduce/use the product?

–

How would you sum up your experience?

Gute Erfahrungen.

Number of employees

Industry

Source

What do you like best?

Wenig Schnickschnack. Direktes Zusammenspiel mit den IST-Daten der Konsolidierung.

What do you like least/what could be improved?

Die Oberfläche, die manchmal etwas komplexe Handhabung, die technisch-fachliche Beratung in der Verfügbarkeit.

What key advice would you give to other companies looking to introduce/use the product?

Nicht ohne XLS-Link arbeiten und wenn irgendwie möglich, die geplanten Termine einhalten, da kurzfristige Verschiebungen so gut wie nicht möglich sind. Unser Berater war jedenfalls eigentlich immer 3-4 Wochen im Voraus verplant.

How would you sum up your experience?

Software läuft und macht aktuell das, was wir wollten. Fachliche Beratung sehr gut, wenn man einen Termin bekommt. Antwortgeschwindigkeit des Supports sollte verbessert werden. In Summe: Kann man gut mit arbeiten.

Number of employees

Industry

Source

What do you like best?

It is functional.

What do you like least/what could be improved?

Integration, scalability with effective price.

What key advice would you give to other companies looking to introduce/use the product?

Get training but consider other options first.

How would you sum up your experience?

It is basic, and we need to understand how to use it better. We've not had enough support and encouragement to do this.

Number of employees

Industry

Source

What do you like best?

Flexibel & schnell anpassbar

What do you like least/what could be improved?

Kaum Innovation.

What key advice would you give to other companies looking to introduce/use the product?

–

How would you sum up your experience?

Alles soweit in Ordnung.

Number of employees

Industry

Source

What do you like best?

Konsolidierungslösung. Integration der verschiedenen Module (Cockpit, Publisher, Designer, Konsis).

What do you like least/what could be improved?

Bei Buttom-Up-Planung je Kostenstelle und Kostenart fehlen die Szenario-Rechnungen im IDL Cockpit (auf GuV Ebene)

What key advice would you give to other companies looking to introduce/use the product?

Konzept muss vorliegen.

How would you sum up your experience?

Grundsätzlich gut. Seit der Fusion mit der insightsoftware sehr viele unterschiedliche Ansprechpartner.