About The Financial Consolidation & Group Accounting Survey

The world's largest survey on financial consolidation. Find out what 453 users think about financial consolidation products and which developments are shaping the financial consolidation world.

The Financial Consolidation & Group Accounting Survey delves into the financial consolidation tools market. The basis of the study is a global survey of 453 software users, offering extensive user feedback on 13 of the leading financial consolidation solutions on the market today.

Participants were asked about the selection and purchase of their software as well as a range of questions about deployment and utilization. The survey also addresses the success of software projects, product usability and challenges faced.

Respondents

Countries

Financial Consolidation Products

Years

Components of The Financial Consolidation & Group Accounting Survey

The findings from The Financial Consolidation & Group Accounting Survey are presented in multiple documents, including The Results and Vendor Performance Summaries. These documents can be read independently.

BARC also provides the raw data via a web-based tool – The Financial Consolidation & Group Accounting Survey Analyzer – enabling users to carry out their own analysis of the survey results.

The Results

An overview and analysis of the most important product-related findings and topical results from The Financial Consolidation & Group Accounting Survey.

The Analyzer

Our powerful interactive online tool, enabling you to perform your own custom analysis of the full survey data set.

Vendor Performance Summary

A series of executive reports on each product featured in The Financial Consolidation & Group Accounting Survey. Each report contains a vendor and product overview by BARC’s analyst team plus all the relevant product-related results from The Financial Consolidation & Group Accounting Survey.

Sample & Methodology

The strength of The Financial Consolidation & Group Accounting Survey lies in its extensive and globally distributed sample of 453 participants, making it one of the largest independent surveys in the world on this subject. This section provides insights into the characteristics of study participants, such as company type, size and industry sector.

Our data cleansing rules are thorough and involve a number of different tests. All fraudulent or suspect data that purports to be from genuine financial consolidation software users is removed.

Sample size and make-up

The survey gathered responses from a diverse group, reaching out to many thousands of individuals through various media channels.

The table displays a summary of participants, with removed responses due to various reasons.

Rigorous data cleansing procedures eliminate fraudulent or suspicious submissions from people purporting to be financial consolidation software users.

The number of responses is divided between users, consultants and vendors. Vendors answered a different set of questions to those answered by users (and consultants answering on behalf of users).

| Responses removed from the samples | Responses |

|---|---|

| Total responses | 453 |

| Removed during data cleansing | 73 |

| Total answering questions | 380 |

| Total responses analyzed | Responses |

|---|---|

| Users | 284 |

| Consultants | 53 |

| All users | 337 |

| Non-users | 27 |

| Vendors/Resellers | 16 |

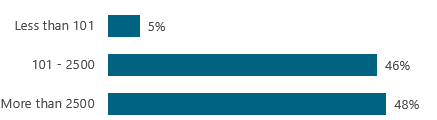

Organization sizes by headcount

Financial consolidation products are predominantly used by mid-sized and large organizations. The majority of responses came from companies with over 100 employees.

Smaller companies (with 100 or fewer employees) constituted the smallest participant group, contributing to 5% of the total responses.

Vertical markets

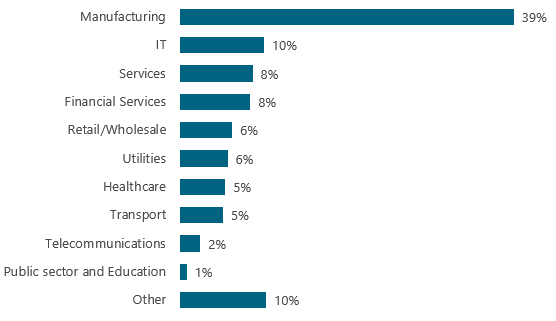

The breakdown of survey responses by industry sector, focusing on users and consultants answering product-related questions, is depicted in the chart.

Manufacturing is the most heavily represented industry with 39% of the sample, followed by IT at 10%.

Products in The Financial Consolidation & Group Accounting Survey

A detailed analysis is conducted on 13 financial consolidation tools, meeting the inclusion threshold of at least 17 user reviews each. For ease of reference, the product names used in The Financial Consolidation & Group Accounting Survey may be abbreviated and might not always align with the official names provided by the vendors at the time of publication.

Respondents were explicitly asked about their experiences with products from a predefined list, with the option to nominate alternatives. Instances where respondents claimed to use an ‘other’ product, yet it became evident from the context that they were actually using one of the listed products, led to the reclassification of their data.

The table on the right shows the financial consolidation products subjected to our in-depth analysis.

| Product name | Respondents |

|---|---|

| CCH Tagetik | 23 |

| elKomSolutions | 23 |

| IBM Controller | 17 |

| insightsoftware IDL | 19 |

| Jedox | 17 |

| LucaNet | 28 |

| OneStream | 20 |

| Oracle Cloud EPM FCC | 32 |

| Prophix | 22 |

| SAP BPC | 20 |

| SAP Group Reporting | 19 |

| SAP SEM-BCS | 18 |

| Talentia CPM | 18 |

The Peer Groups

A range of different financial consolidation tools is featured in The Financial Consolidation & Group Accounting Survey, so we use peer groups to help identify competing products. This approach ensures we make fair and useful comparisons of financial consolidation tools that are likely to compete, for the benefit of readers and vendors alike.

The peer groups are defined each year by BARC analysts using their experience and judgment.

Peer groups serve as a guide to the reader to help make the products easier to understand and to show why individual products return such disparate results. They are not intended to be a judgment of the quality of the products. Most products appear in more than one peer group.

Products in this peer group support the consolidation of the individual financial statements of group companies into a consolidated set of financial statements in accordance with local and/or international accounting standards (e.g., HGB, IFRS, US GAAP, etc.).

- CCH Tagetik

- elKomSolutions

- IBM Controller

- insightsoftware IDL

- Jedox

- Lucanet

- OneStream

- Oracle Cloud EPM FCC

- Prophix

- SAP BPC

- SAP Group Reporting

- SAP SEM-BCS

- Talentia CPM

Products in this peer group are typically (but not exclusively) used in small and midsize groups of companies and scenarios.

- elKomSolutions

- insightsoftware IDL

- Jedox

- Lucanet

- Prophix

- Talentia CPM

Products in this peer group are typically (but not exclusively) used in larger groups of companies and scenarios.

- CCH Tagetik

- IBM Controller

- OneStream

- Oracle Cloud EPM FCC

- SAP BPC

- SAP Group Reporting

- SAP SEM-BCS

The KPIs

The KPIs are designed to help the reader spot winners and losers in The Financial Consolidation & Group Accounting Survey using well-designed dashboards packed with concise information. There is a set of 24 normalized KPIs (which we refer to as ‘root’ KPIs) and 4 aggregated KPIs for each of the 13 products.

The KPIs all follow these simple rules:

- Only measures that have a clear good/bad trend are used as the basis for KPIs.

- KPIs may be based on one or more measures from The Financial Consolidation & Group Accounting Survey.

- Only products with samples of at least 15 – 20 (depending on the KPI) for each of the questions that feed into the KPI are included.

- For quantitative data, KPIs are converted to a scale of 1 to 10 (worst to best).

- A linear min-max transformation is applied, which preserves the order of, and the relative distance between, products‘ scores.

- In some instances, adjustments are made to account for extreme outliers.

KPIs are only calculated if the samples have at least 15 – 20 data points (this varies depending on the KPI) and if the KPI in question is applicable to a product. Therefore some products do not have a full set of root KPIs.

| Aggregated KPIs | Root KPIs |

|---|---|

| Business Value |

Business Benefits Project Success Project Length |

| Competitiveness | Considered for Purchase |

| Customer Satisfaction |

Product Satisfaction Vendor Support Implementer Support Price to Value Recommendation Sales Experience |

| Functionality |

Modeling Flexibility Predefined Connectors Data Entry/Upload Currency Management Workflow Intercompany Reconciliation Consolidation Functionality Traceability/Auditabality Disclosure Management Financial Planning |

| User Experience |

Self-Service Ease of Use Performance Satisfaction |

| Innovation | Cloud-Based Consolidation |